As Biden’s Inflation Hammers Americans, Economists Warn A Subsequent Recession Is ‘Virtually Inevitable’

‘Costs For Food, Gasoline, Housing And Other Necessities [Are] Squeezing American Consumers And Wiping Out The Pay Raises That Many People Have Received’ And Economists Are Now Warning That This Painful Inflation Is Likely To Lead To A Recession

(U.S. Senate Finance Committee Ranking Member, Press Release, 4/12/2022)

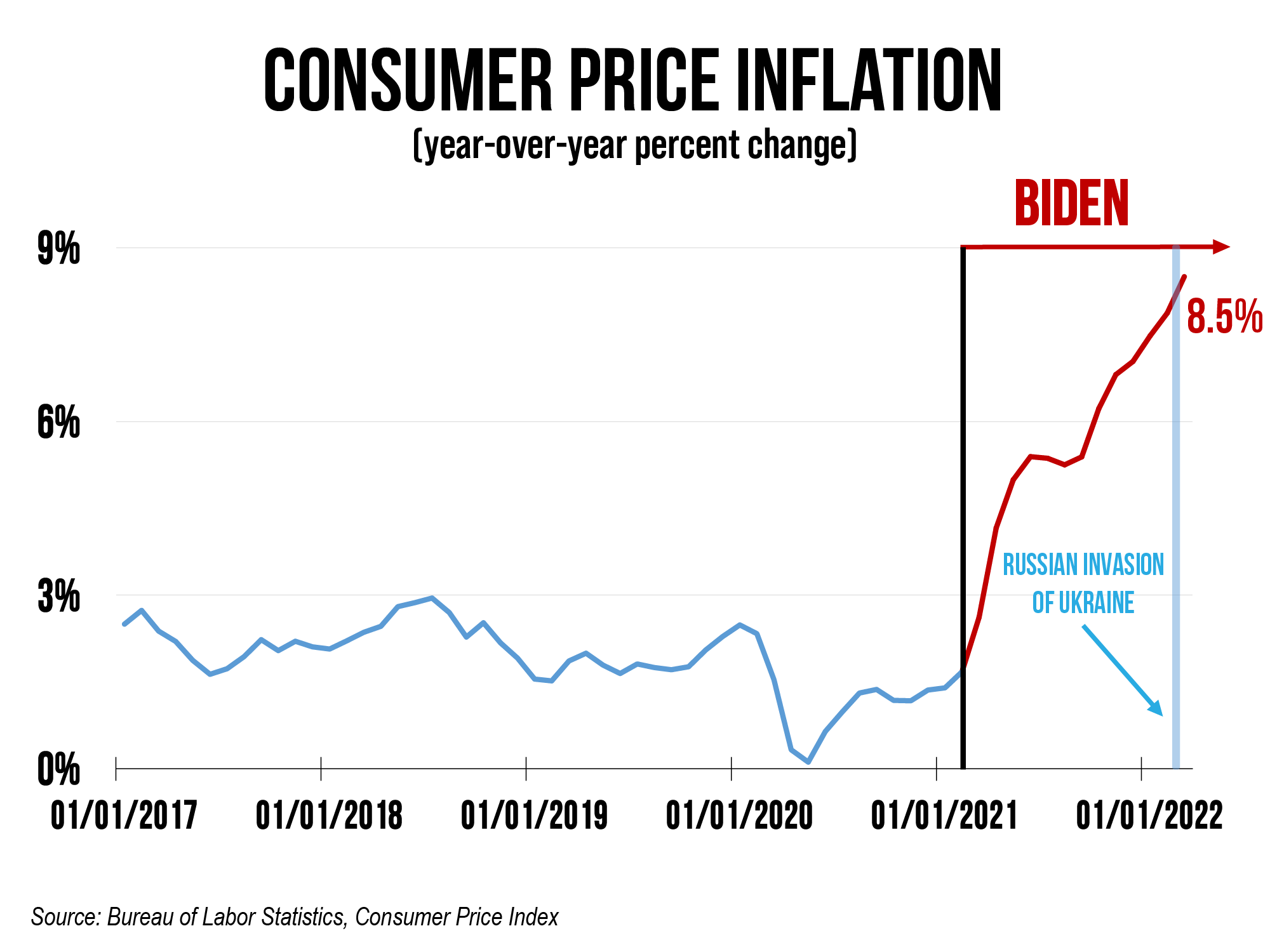

Inflation In March Increased 8.5% Year-On-Year ‘Its Fastest Pace In More Than 40 Years,’ And The Tenth Straight Month In Which Inflation Exceeded 5%

“Inflation soared over the past year at its fastest pace in more than 40 years, with costs for food, gasoline, housing and other necessities squeezing American consumers and wiping out the pay raises that many people have received. The Labor Department said Tuesday that its consumer price index jumped 8.5% in March from 12 months earlier — the biggest year-over-year increase since December 1981.” (“US Inflation Jumped 8.5% In Past Year, Highest Since 1981,” The Associated Press, 4/12/2022)

- “The government’s report also showed that inflation rose 1.2% from February to March, up from a 0.8% increase from January to February.” (“US Inflation Jumped 8.5% In Past Year, Highest Since 1981,” The Associated Press, 4/12/2022)

- “The so-called core price index, which excludes the often-volatile categories of food and energy, increased 6.5% in March from a year earlier—up from February’s 6.4% rise, and sharpest 12-month rise since August 1982.” (“U.S. Inflation Hit Four-Decade High in March,” The Wall Street Journal, 4/12/2022)

“The Labor Department on Tuesday said the consumer-price index—which measures what consumers pay for goods and services—in March rose at its fastest annual pace since December 1981, when it was on a recession-induced downswing after the Federal Reserve aggressively tightened monetary policy. That marks the sixth straight month for inflation above 6% and put it above February’s 7.9% annual rate–well above the Federal Reserve’s target.” (“U.S. Inflation Hit Four-Decade High in March,” The Wall Street Journal, 4/12/2022)

March marked the TENTH consecutive month in which inflation topped 5 percent. (Bureau of Labor Statistics, Accessed 4/12/2022)

- March also marked the FOURTH consecutive month in which inflation rose at least 7 percent. (Bureau of Labor Statistics, Accessed 4/12/2022)

Over The Past Year, Prices For Goods And Services Essential To Everyday Life Have Skyrocketed

“Across the economy, the year-over-year price spikes were widespread in March. Gasoline prices have rocketed 48% in the past 12 months. Used car prices have soared 35.3% … Grocery prices have jumped 10%, including 18% increases for both bacon and oranges. Even excluding volatile food and energy prices, which have driven overall inflation, so-called core inflation jumped 6.5% over the past 12 months, the biggest such increase since 1982.” (“US Inflation Jumped 8.5% In Past Year, Highest Since 1981,” The Associated Press, 4/12/2022)

The price of all items increased 8.5% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 4/12/2022)

- Prices for all items less food and energy increased 6.5% year-on-year, the largest increase since 1982. (Bureau of Labor Statistics, Accessed 4/12/2022)

- Prices for all items less food, shelter, energy, and used cars and trucks increased 5.8% year-on-year, the largest increase since 1991. (Bureau of Labor Statistics, Accessed 4/12/2022)

Food prices increased 8.8% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 4/12/2022)

Food at home (grocery) prices increased 10% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 4/12/2022)

Prices for food away from home increased 6.9% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 4/12/2022)

Prices for new cars and trucks increased 12.6% year-on-year, the largest increase ever. (Bureau of Labor Statistics, Accessed 4/12/2022)

Prices for housing increased 6.4% year-on-year, the largest increase since 1982. (Bureau of Labor Statistics, Accessed 4/12/2022)

Prices for rent of shelter increased 5.1% year-on-year, the largest increase since 1991. (Bureau of Labor Statistics, Accessed 4/12/2022)

Prices for apparel increased 6.8% year-on-year, the largest increase since 1980. (Bureau of Labor Statistics, Accessed 4/12/2022)

‘Inflation Has Proven To Be One Of The Most Blistering Features Of The Pandemic Recovery, One That Weighs Directly On Households Across The Country’

“Inflation has proven to be one of the most blistering features of the pandemic recovery, one that weighs directly on households across the country. Rents are rising, groceries are more expensive, and even wage increases aren’t always enough to cover the basics. And households aren’t expecting a quick reprieve. Survey data from the New York Fed showed that in March 2022, U.S. consumers expected 6.6 percent inflation over the next 12 months, up from 6.0 percent in February. That marked the highest reading since the survey began in 2013, and a steep month-to-month jump. The more households and businesses expect prices will climb in the future, the more self-fulfilling inflation can become.” (“Prices Climbed 8.5% In March, Compared To Last Year, Amid Growing Fears Of Economic Slowdown,” The Washington Post, 4/12/2022)

‘Food Inflation Is Also Raising Consumers’ Grocery Bills, Pushed Up By Steady Price Increases’ For Staple Goods

“Food inflation is also raising consumers’ grocery bills, pushed up by steady price increases for meat, eggs and citrus fruits.” (“U.S. Inflation Hit Four-Decade High in March,” The Wall Street Journal, 4/12/2022)

- “Breakfast cereal was up 2.4 percent from February to March. Rice prices rose 3.2 percent, ground beef grew 2.1 percent, and eggs were up 1.9 percent. Milk was up 1.3 percent, potatoes 3.2 percent, and canned fruits and vegetables tacked on 3.8 percent.” (“Prices Climbed 8.5% In March, Compared To Last Year, Amid Growing Fears Of Economic Slowdown,” The Washington Post, 4/12/2022)

‘The Escalation Of Energy Prices Has Led To Higher Transportation Costs For The Shipment Of Goods And Components Across The Economy, Which, In Turn, Has Contributed To Higher Prices For Consumers’

“Crude oil soared to new highs last month, and rising gasoline prices quickly followed.” (“Prices Climbed 8.5% In March, Compared To Last Year, Amid Growing Fears Of Economic Slowdown,” The Washington Post, 4/12/2022)

- “According to AAA, the average price of a gallon of gasoline — $4.10 — is up 43% from a year ago … The escalation of energy prices has led to higher transportation costs for the shipment of goods and components across the economy, which, in turn, has contributed to higher prices for consumers.” (“US Inflation Jumped 8.5% In Past Year, Highest Since 1981,” The Associated Press, 4/12/2022)

‘There’s An Element Of Sticker Shock … Lower- And Middle-Income Households Are Already Having To Make Choices About What To Buy’

RICHARD F. MOODY, chief economist at Regions Financial Corp: “There’s an element of sticker shock when people go to fill up their tank or go to the grocery store. Lower- and middle-income households are already having to make choices about what to buy because they’re having to pay so much more for food and energy.” (“U.S. Inflation Hit Four-Decade High in March,” The Wall Street Journal, 4/12/2022)

“Alex Salwisz, 40 years old [a program manager in information technology who lives in the Denver suburbs], is facing the rising costs of raising his five children. ‘The thing about having a big family is that each incremental increase is multiplied,’ he said. He said he has tried to substitute generic food products for name-brand foods as prices shot up—not always successfully…. Inflation has eroded their living standard in other ways, Mr. Salwisz said. The children have grumbled when the family crams uncomfortably into the smaller of two vans to save on gas. They have substituted a fast-food meal for the once-a-month sit-down dining experience. He and his wife, Amber Salwisz, are considering scrapping plans for summer camp because of a sharp increase in prices. One partial-day camp increased its price to $800 a week this summer from $500 the prior.” (“U.S. Inflation Hit Four-Decade High in March,” The Wall Street Journal, 4/12/2022)

Compounding The Problem, Americans Are Now Losing Even More Of Their Paychecks To Inflation, With Year-On-Year Real Average Weekly Earnings Decreasing 3.6%

“Real average hourly earnings decreased 2.7 percent, seasonally adjusted, from March 2021 to March 2022. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.6-percent decrease in real average weekly earnings over this period.” (Bureau of Labor Statistics, Press Release, Accessed 4/12/2022)

As Inflation Surges, Economists Warn That The Risk Of Recession Is Growing ‘Uncomfortably High,’ And Could Be ‘Virtually Inevitable’

“Persistently high inflation comes as economists and analysts increasingly fear a looming economic slowdown.” (“Prices Climbed 8.5% In March, Compared To Last Year, Amid Growing Fears Of Economic Slowdown,” The Washington Post, 4/12/2022)

MARK ZANDI, chief economist of Moody’s Analytics, and Democrats’ favorite economist: “Recession risks later this year and into next are now uncomfortably high.” (“How The War In Ukraine Could Hurt The U.S. Economy,” The Huffington Post, 2/25/2022)

LARRY SUMMERS: “The Fed’s current policy trajectory is likely to lead to stagflation, with average unemployment and inflation both averaging over 5 percent over the next few years — and ultimately to a major recession. Indeed, recent research that I conducted with my Harvard colleague Alex Domash shows that overheating conditions of high inflation and low unemployment are usually followed, in short order, by recession.” (Larry Summers, Op-Ed, “The Fed Is Charting A Course To Stagflation And Recession,” The Washington Post, 3/15/2022)

- SUMMERS: “I think the odds are 80 percent that we will have a recession.” (Bloomberg’s ‘Balance of Power,’ 3/10/2022)

- “Former Treasury Secretary Lawrence Summers predicted that the consensus among economists will increasingly fall in line with the U.S. tipping into a recession next year. ‘The combination of overheating, followed by policy delay followed by supply shocks means I think it’s a very difficult set of challenges, and recession in the next couple of years is clearly more likely than not,’ Summers told Bloomberg Television’s ‘Wall Street Week’ with David Westin on Friday. ‘I suspect that’s how the consensus will evolve.’” (“Summers Sees Consensus Building Toward Inevitable U.S. Recession,” Bloomberg, 4/8/2022)

“William Dudley, a former president of the Federal Reserve Bank of New York, called a recession ‘virtually inevitable.’ He is among the economists arguing that if the Fed had begun raising interest rates last year, it might have been able to rein in inflation merely by tapping the brakes on the economy. Now, they say, the economy is growing so rapidly — and prices are rising so quickly — that the only way for the Fed to get control is to slam on the brakes and cause a recession.” (“The U.S. Economy Is Booming. So Why Are Economists Worrying About a Recession?,” The New York Times, 4/5/2022)

“The latest monthly survey of economists by Bloomberg showed the chance of a recession over the coming 12 months increased to 27.5% from 20% in March. Summers also highlighted that the U.S. has never experienced inflation above 4% and unemployment below 4% without that being followed by an economic slump within two years. Last month, consumer prices are estimated to have surged more than 8%, while the jobless rate was 3.6%.” (“Summers Sees Consensus Building Toward Inevitable U.S. Recession,” Bloomberg, 4/8/2022)

“Economists see a growing risk of recession as the relentlessly strong U.S. economy whips up inflation, likely bringing a heavy-handed response from the Federal Reserve. Economists surveyed by The Wall Street Journal this month on average put the probability of the economy being in recession sometime in the next 12 months at 28%, up from 18% in January and just 13% a year ago. ‘Risk of a recession is rising due to the series of supply shocks cascading throughout the economy as the Fed lifts rates to address inflation,’ said Joe Brusuelas, chief economist at RSM US LLP.” (“Recession Risk Is Rising, Economists Say,” The Wall Street Journal, 4/10/2022)

REMINDER: ‘This Is Biden’s Inflation And He Needs To Own It’

STEVEN RATTNER, Former Obama Administration Counselor to the Treasury Secretary: “This is Biden’s inflation and he needs to own it.” (Steve Rattner, @SteveRattner, Twitter, 3/10/2022)

- “A former Treasury Department official who served in the Obama administration on Thursday shot back at President Biden’s stated reasons for the extreme rise in inflation in an op-ed published in The New York Times. Steven Rattner, who served as counselor to the Treasury secretary, wrote in an op-ed for the Times that Biden was mischaracterizing the cause of the extreme inflation the U.S. is currently experiencing. When interviewing Biden last week, NBC News anchor Lester Holt pressed the president on the ongoing rise in inflation, noting that he had said last year that the heightened inflation would be temporary. This line of questioning appeared to vex Biden somewhat as he responded by calling Holt a ‘wise guy.’” (“Former Obama Official: Biden Dishonest To Blame Supply Chain For Inflation,” The Hill, 2/17/2022)

STEVEN RATTNER: “In an interview with Lester Holt of NBC last week, President Biden hewed closely to his talking points on inflation, which over the past 12 months has risen at its fastest rate in 40 years. ‘The reason for the inflation is the supply chains were cut off,’ he insisted, as he has done several times before. Well, no. That’s both simplistic and misleading. For starters, the supply chains have not been ‘cut off,’ just stretched. And supply issues are by no means the root cause of our inflation. Blaming inflation on supply lines is like complaining about your sweater keeping you too warm after you’ve added several logs to the fireplace.” (Steve Rattner, Op-Ed, “Biden Keeps Blaming the Supply Chain for Inflation. That’s Dishonest.,” The New York Times, 2/17/2022)

- “The bulk of our supply problems are the product of an overstimulated economy, not the cause of it. … All that consumption has resulted from vast amounts of government rescue aid (including three rounds of stimulus checks) and substantial underspending by consumers during the lockdown phase of the Covid crisis.” (Steve Rattner, Op-Ed, “Biden Keeps Blaming the Supply Chain for Inflation. That’s Dishonest.,” The New York Times, 2/17/2022)

It Was Quickly Apparent Last Year That Democrats’ Thirst For Government Largesse Had Resulted In A Spending Spree That Was ‘Definitely Too Big For The Moment’ ‘[T]hat Has Contributed Materially To Today’s Inflation Levels’

JASON FURMAN, Former Obama White House chairman of the Council of Economic Advisers: “It’s definitely too big for the moment. I don’t know any economist that was recommending something the size of what was done.” (“Obama, Biden Economists in Conflict on Inflation Jump, Spending,” Bloomberg News, 5/12/2021)

STEVEN RATTNER: “Enough already about ‘transitory’ inflation…. How could an administration loaded with savvy political and economic hands have gotten this critical issue so wrong? They can’t say they weren’t warned — notably by Larry Summers, a former Treasury secretary and my former boss in the Obama administration, and less notably by many others, including me. We worried that shoveling an unprecedented amount of spending into an economy already on the road to recovery would mean too much money chasing too few goods.” (Steven Rattner, Op-Ed, “I Warned the Democrats About Inflation,” The New York Times, 11/16/2021)

- RATTNER: “The original sin was the $1.9 trillion American Rescue Plan, passed in March. The bill — almost completely unfunded — sought to counter the effects of the Covid pandemic by focusing on demand-side stimulus rather than on investment. That has contributed materially to today’s inflation levels.” (Steven Rattner, Op-Ed, “I Warned the Democrats About Inflation,” The New York Times, 11/16/2021)

JASON FURMAN: ‘The United States Has Had Much More Inflation Than Almost Any Other Advanced Economy In The World’ Because ‘The United States’ Stimulus [Spending] Is In A Category Of Its Own’

“‘The United States has had much more inflation than almost any other advanced economy in the world,’ said Jason Furman, an economist at Harvard University and former Obama administration economic adviser, who used comparable methodologies to look across areas and concluded that U.S. price increases have been consistently faster. The difference, he said, comes because ‘the United States’ stimulus is in a category of its own.’” (“Rapid Inflation Fuels Debate Over What’s to Blame: Pandemic or Policy,” The New York Times, 1/22/2022)

LARRY SUMMERS: “I’m not sure that we would have the inflation if there had never been a pandemic and, even if there had been a pandemic, without the overwhelming stimulus that was applied well into recovery — during 2021.” (“Summers Says Pandemic Only Partly To Blame For Record Inflation,” The Harvard Gazette, 2/4/2022)

“At a moment when stubbornly rapid price gains are weighing on consumer confidence and creating a political liability for President Biden, White House officials have repeatedly blamed international forces for high inflation … But a chorus of economists point to government policies as a big part of the reason U.S. inflation is at a 40-year high. While they agree that prices are rising as a result of shutdowns and supply chain woes, they say that America’s decision to flood the economy with stimulus money helped to send consumer spending into overdrive, exacerbating those global trends.” (“Rapid Inflation Fuels Debate Over What’s to Blame: Pandemic or Policy,” The New York Times, 1/22/2022)

“Many economists supported protecting workers and businesses early in the pandemic, but some took issue with the size of the $1.9 trillion package last March under the Biden administration. They argued that sending households another round of stimulus, including $1,400 checks, further fueled demand when the economy was already healing. Consumer spending seemed to react: Retail sales, for instance, jumped after the checks went out. Adam Posen, president of the Peterson Institute for International Economics, said the U.S. government spent too much in too short a time in the first half of 2021.” (“Rapid Inflation Fuels Debate Over What’s to Blame: Pandemic or Policy,” The New York Times, 1/22/2022)

“[E]conomists are increasingly pointing to the scale and size of the $1.9 trillion American Rescue Plan — which Democrats passed less than two months after Biden came to office — as too big to fill the economy’s hole. This stimulus re-extended more generous unemployment benefits of $400 a week, gave many Americans another round of stimulus checks and expanded the Child Tax Credit, though it has since expired. It also strengthened nutritional assistance and school lunch programs. Many Democrats — except a rare few, such as Lawrence H. Summers, who served under Presidents Bill Clinton and Barack Obama — initially waved off concerns that the spending power of the package could overwhelm the economy and flame inflation. But over time, it became clear that the massive influx in cash that went straight to American households, plus billions more dollars pumped into the broader economy, overheated the recovery…. And as time goes on, an increasing number of economists concede that the American Rescue Plan was too big to fill the hole left by the coronavirus recession.” (“What To Know About Inflation: Rising Prices Hit In U.S., Around The World,” The Washington Post, 2/09/2022)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Economy, Inflation

Next Previous