As Families Struggle, Out-Of-Touch Democrats Celebrate Doing Nothing About The Inflation Their Policies Caused

As Democrats Gather At The White House To Again Celebrate Imposing Their Reckless Taxing And Spending Spree On The Country, The Latest Inflation Report Shows American Families Are Still Suffering From Soaring Cost Increases For Their Homes, Their Food, Their Energy, And Their Medical Care

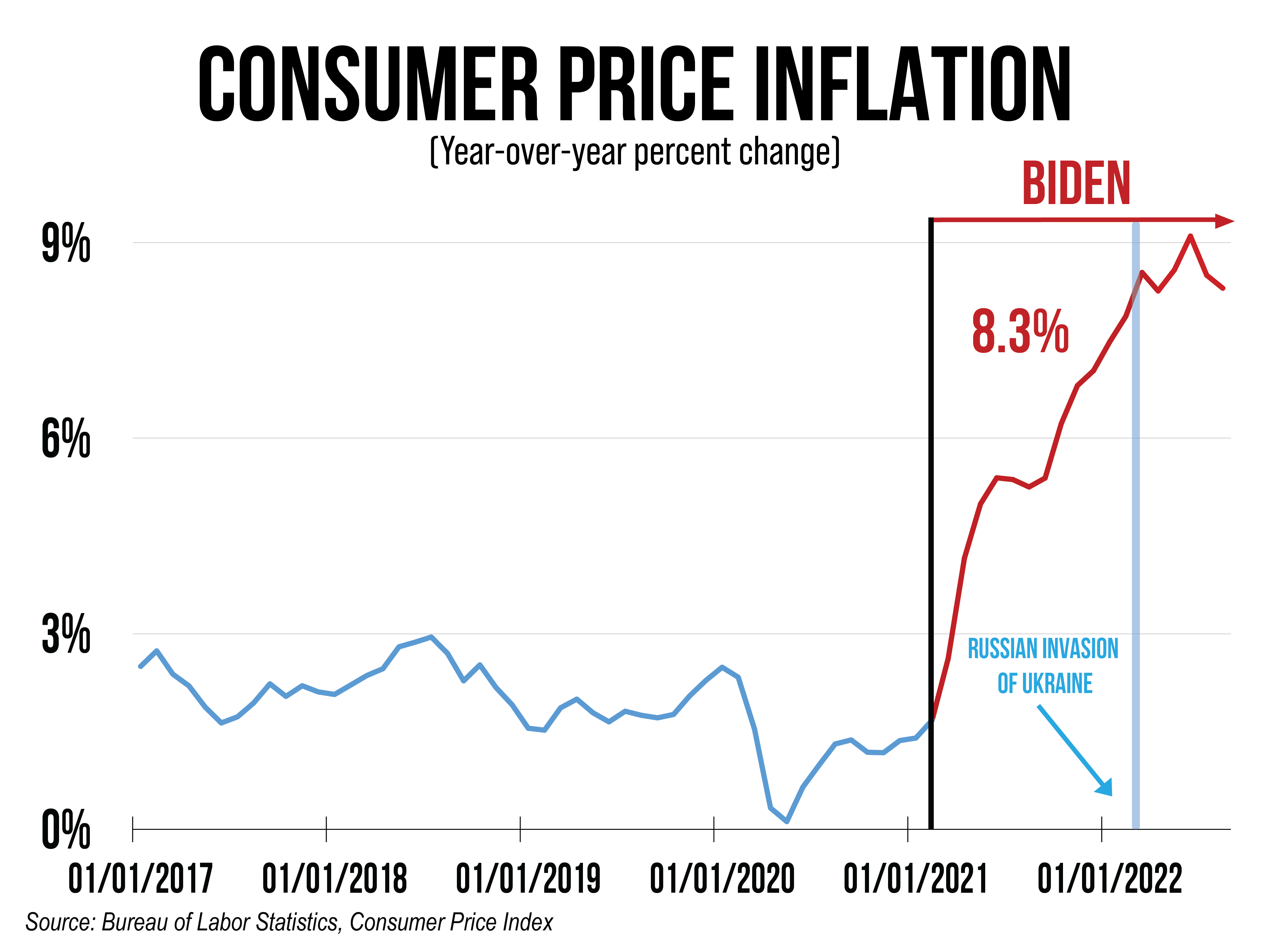

SENATE REPUBLICAN LEADER MITCH McCONNELL (R-KY): “Just a few minutes ago, yet again, the American people received a monthly inflation report that was even worse than the expert predictions. The expectation was that Democrats’ runaway inflation might finally begin to level off. The topline inflation rate was expected to fall. Instead, yet again, the opposite happened. Overall inflation was up even higher. Prices this past August were still 8.3% higher than they were in August 2021. Just a catastrophically high inflation rate. Food prices went up another 0.8% just this past month alone. Overall food prices just logged their biggest one-year increase since the late 1970s. Groceries in particular are now 13.5% more expensive than they were at this time last year. Democrats’ policies are sucker-punching American families every time they set foot in a checkout line…. Housing and shelter costs were up. Medical costs were up. Furniture was up. New cars were up. Electricity costs were way, way up — a 15.8% increase since last year. Let me say that again. Inflation on Americans’ electric bills alone is 15.8% in just the last 12 months. That is the largest one-year increase in electricity prices since 1981 — when the statistic was looking back into the final months of Jimmy Carter…. Prices are 8.3% higher today than in August 2021, but remember, in August 2021, the baseline, we were already talking about runaway inflation! Prices were already way up compared to the year before that. So the 12-month number dramatically understates the total damage that Democrats have caused…. This very day, President Biden and Democrats are having a big celebration for their latest reckless spending bill, which they pretended would reduce inflation, but which nonpartisan experts say will actually make it worse. They could not look more out of touch if they tried.” (Sen. McConnell, Remarks, 9/13/2022)

SEN. MIKE CRAPO (R-ID), Senate Finance Committee Ranking Member: “Widespread underlying inflation is still not under control, and Americans are paying far too much for everyday goods and services. While the White House celebrates the mislabeled ‘Inflation Reduction Act’ today, economic data show that food costs rose 11.4 percent over the past year, the largest 12-month increase since May 1979.” (U.S. Senate Finance Committee Ranking Member, Press Release, 9/13/2022)

‘A New Government Report Showed Price Increases Remain Stubbornly High, Especially For Food And Housing’

(U.S. Senate Finance Committee Ranking Member, Press Release, 9/13/2022)

“Consumer prices in August climbed 0.1 percent compared to the month before … A number of economists had been hopeful that Tuesday’s release would show that inflation is finally cooling, but a new government report showed price increases remain stubbornly high, especially for food and housing. Data released by the Bureau of Labor Statistics on Tuesday showed August prices rose 8.3 percent compared to the year before. Inflation is the economy’s biggest problem, and its toll falls hardest on vulnerable families with little room to absorb higher costs for rent, groceries and everything in between.” (“Rising Food And Housing Costs Pushed Inflation Higher In August,” The Washington Post, 9/13/2022)

- “So-called core CPI, which excludes often volatile energy and food prices, increased 6.3% in August from a year earlier, up sharply from the 5.9% rate in both June and July—a signal that broad price pressures strengthened. On a monthly basis, the CPI increased 0.1% in August from July, despite a sharp decline in gasoline prices. The core CPI rose 0.6% in August–double July’s pace.” (“U.S. Inflation Slowed Slightly to 8.3% in August,” The Wall Street Journal, 9/13/2022)

- “Food prices continued to climb sharply this past month, rising 0.8% in August from July, as did those for new vehicles [which] leapt 0.8%. Prices also rose last month for medical care, education, electricity and natural gas.” (The Wall Street Journal, 9/13/2022)

August marked the SIXTEENTH consecutive month in which inflation rose at least 5 percent. (Bureau of Labor Statistics, Accessed 9/13/2022)

- August also marked the NINTH consecutive month in which inflation rose at least 7 percent. (Bureau of Labor Statistics, Accessed 9/13/2022)

Over The Past Year, Prices For Goods And Services Essential To Everyday Life Have Skyrocketed, With Food And Grocery Prices Increasing The Most Since The 1970s

The price of all items increased 8.3% year-on-year. (Bureau of Labor Statistics, Accessed 9/13/2022)

Food prices increased 11.4% year-on-year, the largest increase since 1979. (Bureau of Labor Statistics, Accessed 9/13/2022)

Grocery (food at home) prices increased 13.5% year-on-year, the largest increase since 1979. (Bureau of Labor Statistics, Accessed 9/13/2022)

Food away from home prices increased 8.0% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 9/13/2022)

Electricity prices increased 15.8% year-on-year, the largest increase since 1981. (Bureau of Labor Statistics, Accessed 9/13/2022)

Prices for housing increased 7.8% year-on-year, the largest increase since 1982. (Bureau of Labor Statistics, Accessed 9/13/2022)

Rental prices for a primary residence increased 6.7% year-on-year, the largest increase since 1986. (Bureau of Labor Statistics, Accessed 9/13/2022)

Medical care prices increased 5.4% year-on-year, the largest increase since 1993. (Bureau of Labor Statistics, Accessed 9/13/2022)

American Families Are Paying $460 More Each Month To Buy The Same Goods And Services

“The average household is spending $460 more each month to buy the same basket of goods and services as last year, said [Ryan] Sweet, the Moody’s economist.” (The Wall Street Journal, 9/13/2022)

Americans Continue Giving Up More Of Their Paychecks To Inflation, With Year-On-Year Real Average Weekly Earnings Decreasing 3.4%

“Real average hourly earnings decreased 2.8 percent, seasonally adjusted, from August 2021 to August 2022. The change in real average hourly earnings combined with a decrease of 0.6 percent in the average workweek resulted in a 3.4-percent decrease in real average weekly earnings over this period.” (Bureau of Labor Statistics, Press Release, Accessed 9/13/2022)

‘High Grocery Costs Are Here To Stay’

“The price of food at the grocery store is expected to increase by up to 11 percent this year with the cost of beef, poultry, milk, eggs and fruit driving the surge. Prices could shoot even higher with droughts affecting crops and a potential rail workers strike halting shipments needed for both food and crop production. The government’s latest Consumer Price Index report released Tuesday shows overall food prices continued to rise, by 0.8 percent in August. That’s slightly down from the month before, but food prices were up 11.4 percent for the year, the largest yearly increase since 1979.” (“Get Ready For A Food Fight: High Grocery Costs Are Here To Stay,” Politico, 9/13/2022)

“Compounding the situation, the agricultural labor market is shorthanded both in the fields and in the production sector, adding additional pressure to prices. Consumer demand is also still high — buoying high costs further. David Anderson, a livestock and food marketing professor at Texas A&M University, said the drought and feedstock prices are pushing ranchers to decrease their herds — which could choke supply. Less supply will mean higher pressure on increased costs.” (“Get Ready For A Food Fight: High Grocery Costs Are Here To Stay,” Politico, 9/13/2022)

‘There’s No Sign These [Electricity] Prices Are Coming Down’

“Electricity prices have jumped 15.8% in the last year, largely as a result of high-priced natural gas, which is used to generate nearly 40% of the nation’s power. The rising price of power has been compounded by soaring temperatures, which have kept air conditioners working overtime. ‘It was one heat wave after another,’ said Mark Wolfe, executive director of the National Energy Assistance Directors Association. ‘Families need to use air conditioning to stay safe.’ NEADA estimates the average family’s cooling costs rose from $450 last summer to about $600 this year…. NEADA predicts the average family will pay $1,202 to heat their home this winter — 17% more than last year. For the six in 10 families whose heat comes from natural gas, the increase in heating costs could be 34%. ‘There’s no sign these prices are coming down,’ Wolfe says. ‘All the signs point to more expensive costs of home heating, and they could spike if it’s cold.’” (“Soaring Electricity Bills Are The Latest Inflation Flashpoint,” NPR, 9/13/2022)

REMINDER: Democrats’ Reckless Taxing And Spending Spree Won’t Reduce Inflation

THE ASSOCIATED PRESS: “With inflation raging near its highest level in four decades, the House on Friday gave final approval to President Joe Biden’s landmark Inflation Reduction Act. Its title raises a tantalizing question: Will the measure actually tame the price spikes that have inflicted hardships on American households? Economic analyses of the proposal suggest that the answer is likely no — not anytime soon, anyway. The legislation, which the Senate passed earlier this week and now heads to the White House for Biden’s signature, won’t directly address some of the main drivers of surging prices — from gas and food to rents and restaurant meals.” (“Inflation Reduction Act May Have Little Impact On Inflation,” The Associated Press, 8/12/2022)

Multiple Independent Expert Analyses Show That Democrats’ Bill Will Do Nothing To Reduce Inflation

“The nonpartisan Congressional Budget Office concluded last week that the changes would have a ‘negligible’ impact on inflation this year and next. And the University of Pennsylvania’s Penn Wharton Budget Model concluded that, over the next decade, ‘the impact on inflation is statistically indistinguishable from zero.’” (“Inflation Reduction Act May Have Little Impact On Inflation,” The Associated Press, 8/12/2022)

- PENN WHARTON BUDGET MODEL: “We estimate that the Inflation Reduction Act as passed by the Senate would have a very modest impact on inflation over the next decade. The Act produces some upward pressure on prices in 2023 and 2024, but its effects are too small to meaningfully affect measured the Personal Consumption Expenditures (PCE) inflation rate as reported by the Bureau of Economic Analysis. The Act would reduce annual inflation by around 0.1 percentage points in about five years, once major deficit-reducing provisions of the legislation are fully implemented, but the Act would have no measurable impact on inflation after 2028. All these point estimates are not statistically different from zero, indicating a low level of confidence that the legislation would have a measurable impact on inflation.” (“Senate-Passed Inflation Reduction Act: Estimates of Budgetary and Macroeconomic Effects,” Penn Wharton Budget Model Website, 8/12/2022)

- “Statistically … CBO’s estimated $21 billion in total deficit reduction amounts to less than 0.018% (2/100th of one percent) of cumulative projected GDP over the same years. That is a tiny fraction of its (single) standard deviation of variation. The impact on inflation is statistically indistinguishable from zero.” (“Inflation Reduction Act: Comparing CBO and PWBM Estimates,” Penn Wharton Budget Model Website, 8/05/2022)

- TAX FOUNDATION: “Inflation is driven by expectations regarding the liklihood that the federal government will be able to repay its debt over the long term, which is a function of the expected performance of the economy, tax collections, and spending. By reducing long-run economic growth, the bill worsens inflation by constraining the productive capacity of the economy…. Lastly, to the extent the durability of the bill’s provisions are in doubt—that is, due to the lack of bipartisan support—it may have little impact on expectations about the fiscal outlook and therefore inflation. On balance, the long-run impact on inflation is particularly uncertain but likely close to zero.” (“Details & Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation Website, 8/12/2022)

Democrats’ Green New Deal Spending Certainly Won’t Reduce Skyrocketing Grocery Prices

“Economists are uncertain that the IRA or any of the other provisions will have an effect on rising food costs. ‘The majority of those federal programs and funds [in the IRA] are targeted at conservation, you know, potentially increasing conservation efforts around the country,’ said Glynn Tonsor, an agricultural economics professor at Kansas State University. ‘That’s not the same as increasing production, and that’s relevant for the food price discussion because I haven’t seen anything that’s really about increasing production volume. [And] that would be one mechanism, obviously, to reduce food prices if we increased the volume produced.’” (“Get Ready For A Food Fight: High Grocery Costs Are Here To Stay,” Politico, 9/13/2022)

Not Only Will The Bill Do Nothing To Reduce Inflation, ‘The Law’s Health Care Subsidies Could Send Inflation Up’

“In addition, Kent Smetters, director of the Penn Wharton Budget Model, said the law’s health care subsidies could send inflation up. The legislation would spend $70 billion over a decade to extend tax credits to help 13 million Americans pay for health insurance under the Affordable Care Act.” (“Inflation Reduction Act May Have Little Impact On Inflation,” The Associated Press, 8/12/2022)

TAX FOUNDATION: “By increasing spending, the bill worsens inflation, especially in the first four years, as revenue raisers take time to ramp up and the deficit increases. We find that budget deficits would increase from 2023 to 2026, potentially worsening inflation. To the extent the tax credits and health-care subsidies are expected to be extended on a permanent basis, these policies put upward pressure on inflation.” (“Details & Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation Website, 8/12/2022)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Economy, Inflation, Senate Democrats

Next Previous