05.13.25

Building on the Successes of Republicans’ Tax Cuts and Jobs Act

Americans Overwhelmingly Support Keeping the Tax Cuts and Jobs Act as Republicans Aim to Make it Permanent to Deliver Even More Benefits for Families and Small Businesses

THE TAX CUTS AND JOBS ACT (TCJA) LOWERED TAXES FOR WORKING FAMILIES AND MAIN STREET, AND AMERICANS WANT CONGRESS TO KEEP THESE MEASURES IN PLACE

- “The Tax Cuts and Jobs Act lowered taxes for most U.S. households, experts said. The legislation was broad, benefiting Americans across the income spectrum…” (CNBC: ‘Reverse Robin Hood scam’ or windfall for middle class? Lawmakers debate Trump tax plan extensions – 3/3/25)

- “The TCJA cut taxes more for working families than rich families on a proportional basis.”

- “The bottom 50% of Americans saw their average federal tax rate fall by 15% from 2017 to 2018, after the Trump tax cut took effect.”

- “By contrast, the top 1% saw their average rate decline by a lesser percentage (about 5%) during that period.” (CNBC: ‘Reverse Robin Hood scam’ or windfall for middle class? Lawmakers debate Trump tax plan extensions – 3/3/25)

- Wages grew 3.4% the year after the TCJA became law, “the fastest pace in nearly a decade and well above inflation.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

- The TCJA “created a new deduction of 20% of net income for many pass-through business owners, effectively lowering their top rate to 29.6% from 37%,” creating “a boon for small businesses.” (The Wall Street Journal: The New Tax Law: Pass-Through Income – 2/13/18; CNBC: Small businesses cheer Trump tax reforms, but some feel they didn’t go far enough – 3/18/19)

- “[L]etting the tax reforms lapse would result in a $4 trillion tax increase in 2026…” (The Wall Street Journal: Editorial: Republicans Reconcile on Taxes – 2/14/25)

- Extending the TCJA is broadly popular: “More than 8 in 10 likely voters want President Trump’s 2017 tax cuts extended before they expire at the end of this year, according to a new poll released as Congress rushes to finalize a ‘big, beautiful’ bill making those provisions permanent.” (New York Post: More than 8 in 10 voters support keeping Trump’s 2017 tax cuts: poll – 5/5/25)

- Additionally, 62% of Americans support keeping the small business tax deduction in place, and 77% agree that the deduction “helps level the playing field for small businesses.” (NFIB: New Polling Shows Strong Support for 20% Small Business Tax Deduction – 4/7/25)

PRESIDENT TRUMP, HIS ADMINISTRATION, AND SENATE REPUBLICANS ARE UNITED IN WORKING TO MAKE THESE POPULAR PROVISIONS PERMANENT

- “Near the top of the agenda for our historic Republican majorities in Congress is to pass a massive tax cut for American workers and families. Last year we campaigned across the country. We had a pledge that I'm sure most of you didn't hear too much about, a pledge to take the Trump tax cuts and make them permanent. And that's exactly what we're doing.” – President Donald Trump

- “In the first 100 days of the new administration, we have set the table for a robust economy that allows Main Street to grow. With Congress and the White House working hand in hand, we expect to see even more positive results over the next few months. Key to expanding economic opportunity for all Americans is making the Trump tax cuts permanent.” – Secretary of the Treasury Scott Bessent

- “[I]f we don’t extend the Tax Cuts and Jobs Act, small businesses will face a $600 billion tax hike in 2026. Republicans do not intend to let that happen. But we don’t just want to extend the TCJA’s provisions. We want to give small businesses certainty by making these pro-growth tax policies permanent.” – Senate Majority Leader John Thune (R-S.D.)

- “Our conference is united in preventing an over-$4 trillion tax hike on American families and businesses and delivering additional tax relief to those who have suffered under four years of inflation. We are united in making this proven tax policy permanent to provide the certainty that businesses need to make the long-term investments that drive growth and the stability that families need as they save and plan for the future.” – Senate Finance Committee Chairman Mike Crapo (R-Idaho)

- “A temporary extension of these pro-growth and pro-family policies is a missed opportunity.Businesses need certainty while investing in their companies and taxpayers should not fear tax hikes due to Congressional inaction. Congressional Republicans have an historic opportunity to enact this lasting tax relief.” – Nine Republican Senate Finance Committee Members

THE BENEFITS OF MAKING THE TCJA PERMANENT ARE CLEAR: MORE JOBS, HIGHER WAGES, HIGHER GDP

- “Tax breaks enacted to help small businesses aren’t permanent” under current law, “and that’s made it difficult for business owners to make long-term decisions.” (CNBC: Small businesses cheer Trump tax reforms, but some feel they didn’t go far enough – 3/18/19)

- According to the National Federation of Independent Business (NFIB), a permanent extension of the small business tax deduction would create 1.2 million jobs annually over the first ten years, growing to 2.4 million per year in the long run. (EY on Behalf of the NFIB: Macroeconomic impacts of permanently extending the Section 199A deduction on small businesses – Sept. 2024)

- According to the Tax Foundation, after-tax income would increase by 2.9% in 2026 if the TCJA is made permanent. (Tax Foundation: Making the Tax Cuts and Jobs Act Permanent: Economic, Revenue, and Distributional Effects – 2/26/25)

- The Tax Foundation estimates that making the TCJA permanent would increase GDP in the long run by 1.1%. (Tax Foundation: Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations – 5/7/24)

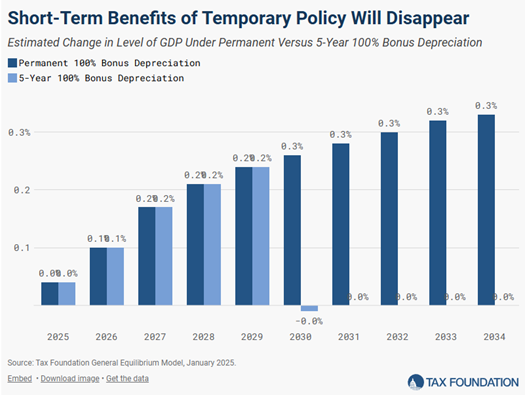

- “The Tax Cuts and Jobs Act (TCJA) introduced 100 percent bonus depreciation,” which allowed “businesses to immediately deduct expenses for investments in depreciable assets like equipment and qualified improvement property, as well as certain intangible property like software.” (Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25; Reuters: Trump Pledges to Restore TCJA Full Bonus Depreciation – 3/6/25)

- “Permanent improvements to investment incentives will deliver permanent improvements to the level of investment and output in the United States.”

(Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25)

Next Previous