‘Reducing Taxes For The Middle Class’

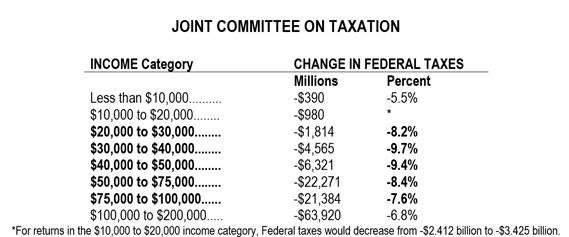

The Senate ‘Finance Committee Plan Cuts Tax Rates Across The Board’

‘Laser-Focused… On Reducing Taxes For The Middle Class’

SEN. ORRIN HATCH (R-UT): “[W]e have been laser-focused… on reducing taxes for the middle class. And that is exactly what this bill will do.” (Sen. Hatch, Press Release, 11/10/2017)

FINANCE COMMITTEE: “The Finance Committee plan cuts tax rates across the board. The proposal also repeals a number of tax credits and benefits that predominantly benefit wealthy taxpayers, so the slightly lower top rate will apply to a larger income base.

The bill also:

- Nearly doubles the standard deduction from $6,350 to $12,000 for individuals, from $12,700 to $24,000 for married couples, from $9,350 to $18,000 for single parents.

- Expands the child tax credit from $1,000 to $2,000 increases refundability, and allows many more parents to claim the credit by substantially lifting existing caps.

Combined, these reforms mean lower taxes and bigger paychecks for tens of millions of middle-class American families.” (“Charge And Response,” Senate Finance Committee, 11/21/2017)

Examples Of How The Senate Proposal Will Help American Families

“How the Senate proposal will help Americans: A family of four with income of around $73,000 (median family income) will see a tax cut of nearly $2,200.

- Their tax bill will fall from what they pay today, around $3,683, to paying $1,499 next year—a reduction of $2,184.” (“Tax Cuts & Jobs Act: Real World Impact,” Senate Finance Committee, 11/20/2017)

“A single parent with one child earning $41,000 will see a tax cut of nearly $1,400.

- Their tax bill will fall from what they are paying today, around $1,865, to paying $488 next year—a reduction of $1,377.” (“Tax Cuts & Jobs Act: Real World Impact,” Senate Finance Committee, 11/20/2017)

“Married small business owners with income of $100,000… will see a tax cut of more than $2,850.

- A couple earning $100,000, with $60,000 from wages, $25,000 in compensation from their non-corporate business, and $15,000 of business income… Their tax bill will fall from what they pay today, around $11,280, to paying around $8,425 next year—a reduction of $2,855.” (“Tax Cuts & Jobs Act: Real World Impact,” Senate Finance Committee, 11/20/2017)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Middle Class, Jobs, Taxes, Economy, Tax Reform

Next Previous