11.21.25

Republicans Are Tackling the Affordability Crisis Democrats Created

Republicans Are Champions of Lower Taxes and Driving Down Costs. Democrats’ Policies Caused the Worst Inflation in 40 Years.

UNDER FOUR YEARS OF PRESIDENT BIDEN, DEMOCRATS WRECKED THE ECONOMY

- Inflation hit a 40-year high under President Biden, affecting everything from groceries, to gas, to housing. (The Associated Press: US inflation at new 40-year high as price increases spread – 6/10/22)

- During President Biden’s time in office, costs skyrocketed across the board:

- All prices rose an average of 20.65%.

- Grocery prices, measured as “food at home,” increased by 22.32%.

- Energy prices increased by 30.54%.

- Gasoline prices increased by 30.50%.

- Electricity prices increased by 28.55%.

- Natural gas prices increased by 33.30%.

- Rent prices increased by 24.19%.

- Car repair and maintenance prices increased by 34.33%. (U.S. Bureau of Labor Statistics: Consumer Price Index News Release – 2/10/21; U.S. Bureau of Labor Statistics: Consumer Price Index News Release – 1/15/25)

- “…[T]he Biden administration and Congressional Democrats made a $1.9 trillion bet in the form of the American Rescue Plan. They lost, as it contributed to a surge in inflation that fueled massive voter discontent and Donald Trump's return to the White House.” (Axios: Democrats' $1.9 trillion bet that blew up – 11/10/24)

DEMOCRATS HAVE SPENT MONTHS NOW RAILING AGAINST THEIR OWN “AFFORDABLE” CARE ACT THAT THEY NOW ADMIT FAILED TO LOWER COSTS

- As Obamacare was being passed, Democrats had lofty predictions for how it would fix the American health care system and lower costs:

- “Who would have thought that we could finally get a handle on the thing that is driving our budget deficit to great heights, which is health care costs, and at the same time do so much good by covering so many people.” – Sen. Chuck Schumer (D-N.Y.) (12/24/09)

- “Our effort is to make health insurance more affordable for individuals and small businesses.” –Sen. Dick Durbin (D-Ill.) (12/3/09)

- “[A]n historic bill that will finally reform our broken health care system and help millions of our families and small businesses get the coverage they need at a price they can afford. It is about time.” – Sen. Patty Murray (D-Wash.) (11/19/09)

- But now, facing the results of their failed policies, Democrats are sounding the alarm:

- “We did fail to bring down the cost of healthcare.” – Sen. Peter Welch (D-Vt.)

- “[T]he healthcare crisis is so deep and so real.” – Senate Democrat Leader Chuck Schumer (D-N.Y.)

- “[W]e’re in a health care crisis right now.” – House Democrat Leader Hakeem Jeffries (D-N.Y.)

- “Now, right now, we have a broken health care system. Nobody can afford health care.” – Sen. Bernie Sanders (I-Vt.)

- “People are scared about how they are going to pay for their healthcare or if they are going to have it at all.” – Sen. Brian Schatz (D-Hawaii)

- “People are literally standing on a health care cliff right now.” – Sen. Amy Klobuchar (D-Minn.)

- “The real problem is that the Affordable Care Act was never actually affordable.” (The Washington Post: Editorial: The shutdown conversation no one wants – 10/5/25)

- Premiums for the average Obamacare enrollee have increased 221% between 2013 and 2025. (U.S. Department of Health and Human Services: Individual Market Premium Changes: 2013 – 2017 – 5/23/17; Paragon Health Institute: Almost Entire Obamacare Premium Increases Paid for By Taxpayers – accessed 11/20/25)

- “In other words, Obamacare has been an engine of insurance premium inflation. Democrats have tried to cover up that fact with ever more taxpayer subsidies.” (Forbes: How Obamacare Set In Motion Today’s Premium Crisis – 10/14/25)

REPUBLICANS JUST THIS YEAR DELIVERED PERMANENT TAX RELIEF AND NUMEROUS POLICIES TO LOWER COSTS FOR WORKING AMERICANS

- “Americans dodged a big tax hike when Congress passed the ‘big, beautiful bill,’ making permanent the tax cuts of President Trump's first term — and adding on a bunch more.” (Axios: How your county is affected by "big beautiful bill" tax cuts – 8/18/25)

- Republicans’ Working Families Tax Cuts prevented a $4.3 trillion tax increase on the American people, including a $2.6 trillion tax hike on households earning less than $400,000 per year. (U.S. Senate Committee on Finance: Crapo Highlights Tax Wins for Hardworking Americans and Main Street – 6/28/25; The Wall Street Journal: Editorial: Republicans Reconcile on Taxes – 2/14/25; U.S. Senate Committee on Finance: Crapo: Senate Republican Plan Powers Economic Growth, Delivers Tax Relief – 6/30/25)

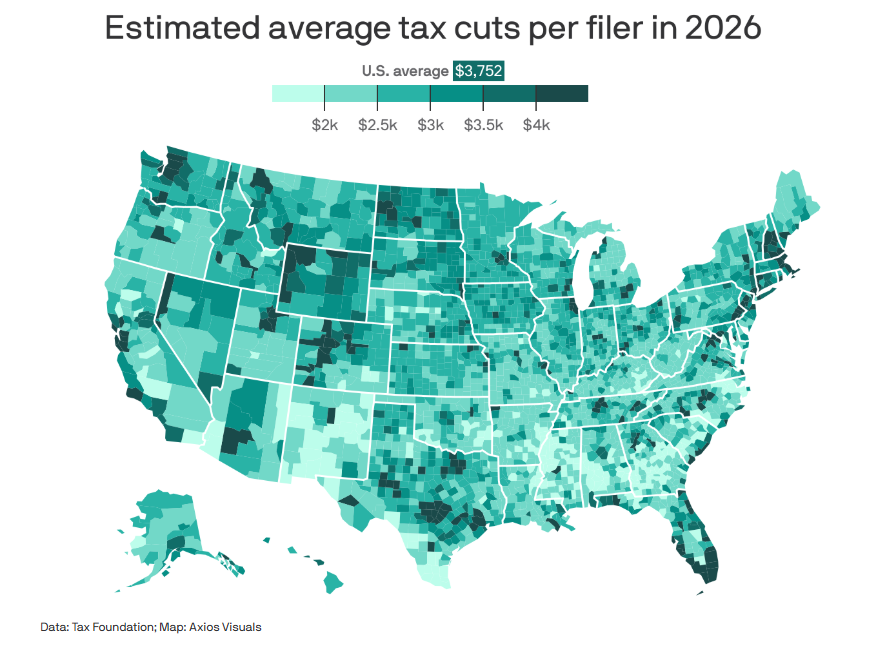

- “The average American will receive a federal tax cut of $3,752 in 2026 thanks to the bill, per an analysis from the Tax Foundation.” (Axios: How your county is affected by "big beautiful bill" tax cuts – 8/18/25)

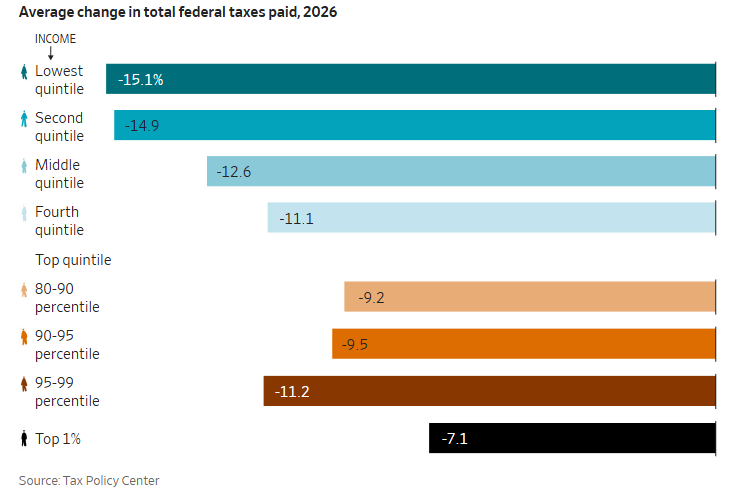

- Americans with the lowest incomes will see the biggest decrease in taxes:

(The Wall Street Journal: Here Are the Winners From Trump’s Tax Law – 7/26/25)

- The Working Families Tax Cuts in Republicans’ One Big Beautiful Bill Act are bringing relief to every state and county in the country.

(Axios: How your county is affected by "big beautiful bill" tax cuts – 8/18/25)

- “The big bill not only made the 2017 tax cuts permanent, it added on new breaks: deductions for tips and overtime income, a cut for seniors and an expanded child-care tax cut.” (Axios: How your county is affected by "big beautiful bill" tax cuts – 8/18/25)

- “Many Americans could see heftier tax refunds next year when they file their 2025 tax returns, largely due to new provisions enacted through the Republicans' ‘one big, beautiful bill’ act that are retroactive to the start of the current year, according to an analysis from Oxford Economics.” (CBS News: Americans may get bigger tax refunds next year, economic study finds – 10/22/25)

- “Total taxpayer savings could amount to an additional $50 billion through bigger tax refunds or a cut in their 2026 taxes, Oxford lead economist Nancy Vanden Houten wrote in the Oct. 21 report.” (CBS News: Americans may get bigger tax refunds next year, economic study finds – 10/22/25)

- “A $50 billion boost in tax refunds would represent an 18% increase from the $275 billion in refunds the IRS sent this year to nearly 94 million taxpayers who overpaid on their 2024 federal tax returns, according to data from the agency. The average refund in 2025 was $2,939, according to the IRS.” (CBS News: Americans may get bigger tax refunds next year, economic study finds – 10/22/25)

- “Seniors are also likely to enjoy a bigger tax refund in early 2026, with the new $6,000 deduction for people over 65 years old under the ‘big, beautiful bill’ providing as much as $9.3 billion in tax savings, the Oxford estimated.” (CBS News: Americans may get bigger tax refunds next year, economic study finds – 10/22/25)

REPUBLICANS ALSO ENACTED HEALTH CARE REFORMS THAT GIVE MORE AMERICANS ACCESS TO HEALTH SAVINGS ACCOUNTS SO THEY CAN USE PRETAX MONEY TO COVER PERSONAL HEALTH CARE COSTS

- Thanks to Republicans’ One Big Beautiful Bill Act, “more people will be able to benefit from the triple tax-advantaged health savings account, or HSA,” “enabling millions more enrollees to open and contribute to HSAs without having to change insurance plans.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25; White House: Expansion of HSA Eligibility Under OBBB Act to Improve Marketplace Coverage, Affordability, and Access – 9/26/25)

- “H.S.A.s let people set aside pretax money for health and medical care, whether they need it now or in the future. Funds not needed for current health care can be saved or invested to grow over time, providing funds for care later in life. Money in the accounts grows tax-free and is tax-free when withdrawn and spent on eligible care or products.” (The New York Times: New Rules Aim to Broaden Appeal of H.S.A.s – 11/7/25)

- “HSA plans are a favorite savings vehicle among financial advisers because contributions are tax-free, money grows tax-free, and if used for a qualifying expense, withdrawals are tax-free.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25)

- “As a result of the budget legislation, ‘bronze’ and ‘catastrophic’ health plans offered on federal and state health insurance marketplaces now qualify for H.S.A.s.” (The New York Times: New Rules Aim to Broaden Appeal of H.S.A.s – 11/7/25)

- “Previously, those plans — which have higher deductibles and lower monthly premiums than the ‘silver’ and higher tiers of Obamacare plans — didn’t qualify for H.S.A.s.” (The New York Times: New Rules Aim to Broaden Appeal of H.S.A.s – 11/7/25)

- “Funds in an H.S.A. can now be used to pay fees for so-called direct primary care arrangements, in which patients pay a monthly or annual subscription fee to their doctor. In exchange, they get benefits like same-day appointments and unlimited office or online visits, as well as a bundle of services including some tests and minor procedures, like suturing.” (The New York Times: New Rules Aim to Broaden Appeal of H.S.A.s – 11/7/25)

- “Doctors like the arrangement, he said, because it allows them to avoid the hassle of dealing with insurers and gives them more control over the amount of time they spend with patients.” (The New York Times: New Rules Aim to Broaden Appeal of H.S.A.s – 11/7/25)

- “The HSA changes made in the law ‘represent the most significant HSA expansion in nearly two decades,’ according to health and benefits platform Lively.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25)

Previous