06.03.25

Republicans’ Tax Plan: Delivering Lasting Relief for American Families and Small Businesses

Senate Republicans Will Pass Legislation Implementing President Trump’s Pro-Family, Pro-Growth Agenda

LETTING THE TAX CUTS AND JOBS ACT (TCJA) EXPIRE WOULD RAISE TAXES ON WORKING FAMILIES

- “Unless Congress acts, marginal income-tax rates will increase in 2026.” (The Wall Street Journal: Breaking Down What’s in the GOP Tax Bill – 5/22/25)

- “The Tax Cuts and Jobs Act lowered taxes for most U.S. households, experts said. The legislation was broad, benefiting Americans across the income spectrum…” (CNBC: ‘Reverse Robin Hood scam’ or windfall for middle class? Lawmakers debate Trump tax plan extensions – 3/3/25)

- “The TCJA cut taxes more for working families than rich families on a proportional basis.”

- “The bottom 50% of Americans saw their average federal tax rate fall by 15% from 2017 to 2018, after the Trump tax cut took effect.”

- “By contrast, the top 1% saw their average rate decline by a lesser percentage (about 5%) during that period.” (CNBC: ‘Reverse Robin Hood scam’ or windfall for middle class? Lawmakers debate Trump tax plan extensions – 3/3/25)

- Wages grew 3.4% the year after the TCJA became law, “the fastest pace in nearly a decade and well above inflation.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

- “[L]etting the tax reforms lapse would result in a $4 trillion tax increase in 2026…” (The Wall Street Journal: Editorial: Republicans Reconcile on Taxes – 2/14/25)

-

- A family of four making $80,000 would see a $1,700 tax increase if the TCJA expires. (Tax Foundation: Tax Calculator: How the TCJA’s Expiration Will Affect You – 3/12/24)

-

- The child tax credit would return to $1,000 per child, down from the TCJA level of $2,000. (Bloomberg Government: Will Trump and Congress Extend TCJA Tax Cuts? – 2/20/25)

-

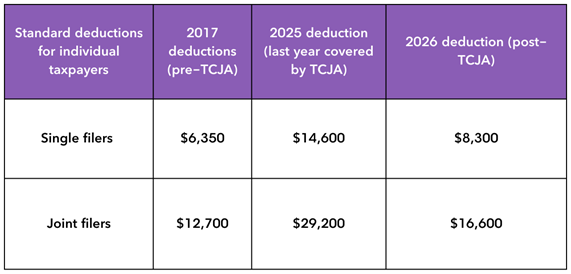

- The standard deduction, which nearly 90% of taxpayers claim, would be cut roughly in half. (Tax Foundation: Nearly 90 Percent of Taxpayers Are Projected to Take the TCJA’s Expanded Standard Deduction – 9/26/18)

Standard Deductions Before and After TCJA

(Bloomberg Government: Will Trump and Congress Extend TCJA Tax Cuts? – 2/20/25)

- According to modeling done by the Tax Foundation, tax provisions in Republicans’ reconciliation bill “would lower marginal tax rates on work in the United States,” expanding on the TCJA’s cuts for hardworking Americans. (Tax Foundation: “Big Beautiful Bill” House GOP Tax Plan: Preliminary Details and Analysis – 5/23/25)

- The White House Council of Economic Advisers projects “$7,800 to $13,300 higher take-home pay for a typical family with two children” in the long run as a result of Republicans’ tax legislation. (White House: Preserving and Expanding Low Tax Rates to Create American Economic Prosperity – May 2025)

PUTTING MAIN STREET FIRST, REPUBLICANS’ PRO-GROWTH TAX LEGISLATION WILL BUILD ON THE TCJA’S SUCCESSES FOR SMALL BUSINESSES

- The TCJA “created a new deduction of 20% of net income for many pass-through business owners, effectively lowering their top rate to 29.6% from 37%.” (The Wall Street Journal: The New Tax Law: Pass-Through Income – 2/13/18)

- Nationally, 96% of small businesses are considered pass-through businesses, comprising 33 million businesses that employ more than 68 million workers. Out of those 33 million businesses, 25.9 million of them claimed the small business tax deduction in 2021. (EY on Behalf of NFIB: Macroeconomic impacts of permanently extending the Section 199A deduction on small businesses – Sept. 2024)

- “Workers are receiving the fattest wage increases since the Great Recession as employers struggle to find enough people to fill their ranks and employees have more leverage to demand higher pay and jump to better jobs.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

- The Tax Foundation forecasts that, due to Republicans’ tax legislation, “[h]ours worked would expand by 983,000 full-time equivalent jobs,” increasing take-home pay and growing the economy in the process. (Tax Foundation: “Big Beautiful Bill” House GOP Tax Plan: Preliminary Details and Analysis – 5/23/25)

- Over the next four years, these tax provisions are projected to create “4.2 to 5.2 percent higher GDP” and “6.6 to 7.4 million full-time equivalent (FTE) jobs saved or created,” according to the White House Council of Economic Advisers. (White House: Preserving and Expanding Low Tax Rates to Create American Economic Prosperity – May 2025)

AMERICANS SUPPORT KEEPING THE TCJA AND ITS SMALL BUSINESS TAX POLICIES IN PLACE – AND OPPOSE DEMOCRAT EFFORTS TO RAISE TAXES

- Extending the TCJA is broadly popular: “More than 8 in 10 likely voters want President Trump’s 2017 tax cuts extended before they expire at the end of this year, according to a new poll released as Congress rushes to finalize a ‘big, beautiful’ bill making those provisions permanent.”

- The same poll found, “Clear majorities of voters see not extending the 2017 tax cuts as hurting middle class families [75%], small businesses [74%], American consumers [74%], and the economy” overall (69%).

- “80% of potential voters said it was not ideal to increase taxes — up four percentage points from September — and a mere 3% said it was a good time for an increase.” (New York Post poll – 5/5/25)

- “By a nearly 3- to- 1 margin (64% to 20%), voters favor permanently extending the TCJA noting its ability to reduce and simplify the federal tax burden on families and businesses, stimulate economic growth, create jobs, and enhance the global competitiveness of American companies.”

- “Support for permanent tax relief transcends partisan lines, with 81% of Republicans, 55% of Independents, and even a majority—53%—of Democrats backing the 2017 tax law.”

- “78% believe the best way to balance the budget is by holding the line on taxes, cutting wasteful spending, and promoting pro-growth policies—rather than increasing taxes.” (U.S. Chamber of Commerce poll – 3/4/25)

- “Americans, regardless of political affiliation, want permanent tax cuts. Seventy-five percent agree with the statement, ‘the 2017 tax cuts should be made permanent because businesses and families need stability of the tax code to plan for the future.’ And 74 percent agree that ‘tax cuts should be made permanent because taxes are already too high.’ More than half of ‘very liberal’ respondents also agreed with both statements.” (CATO Institute poll – 4/14/25)

- An April 2025 NFIB poll found that 62% of Americans are supportive of keeping the 20% small business tax deduction, with 79% saying they “believe the Small Business Tax Deduction has a positive impact on the economy overall.” (NFIB poll – 4/7/25)

Next Previous