Small Businesses Need and Deserve Tax Certainty

Senate Republicans Are Working to Make the Tax Cuts and Jobs Act Permanent, Giving Small Businesses Long-Term Relief and Certainty

THE TAX CUTS AND JOBS ACT WAS REVOLUTIONARY FOR SMALL BUSINESSES AND MAIN STREET AMERICA

- The Tax Cuts and Jobs Act (TCJA) “created a new deduction of 20% of net income for many pass-through business owners, effectively lowering their top rate to 29.6% from 37%.” (The Wall Street Journal: The New Tax Law: Pass-Through Income – 2/13/18)

- Nationally, 96% of small businesses are considered pass-through businesses, comprising 33 million businesses that employ more than 68 million workers. Out of those 33 million businesses, 25.9 million of them claimed the small business tax deduction in 2021. (EY on Behalf of NFIB: Macroeconomic impacts of permanently extending the Section 199A deduction on small businesses – Sept. 2024)

- “[T]he tax breaks have been a boon for small businesses.” (CNBC: Small businesses cheer Trump tax reforms, but some feel they didn’t go far enough – 3/18/19)

- Nearly 80% of National Federation of Independent Business (NFIB) members polled in their 2021 Tax Survey report “described the tax law positively, compared to just 8% who had a negative view of the tax law.” (NFIB Research Center: NFIB Tax Survey 2021 – June 2021)

- The year after the TCJA was passed, wages grew 3.4%, “the fastest pace in nearly a decade and well above inflation.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

- “Workers are receiving the fattest wage increases since the Great Recession as employers struggle to find enough people to fill their ranks and employees have more leverage to demand higher pay and jump to better jobs.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

MAKING THE TCJA’S CAPITAL INVESTMENT DEDUCTION PROVISION PERMANENT WILL HAVE LONG-TERM BENEFITS FOR SMALL BUSINESSES

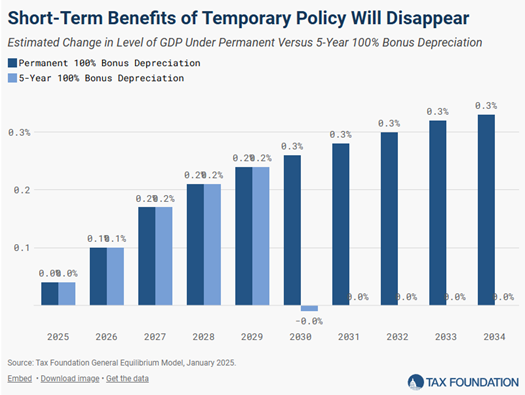

- “The Tax Cuts and Jobs Act (TCJA) introduced 100 percent bonus depreciation for short-lived assets, like equipment and machinery, from September 27, 2017, through January 1, 2023. Starting in 2023, bonus depreciation decreases by 20 percentage points annually, phasing out completely by 2027.” (Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25)

- Bonus depreciation “allows businesses to immediately deduct expenses for investments in depreciable assets like equipment and qualified improvement property, as well as certain intangible property like software.” (Reuters: Trump Pledges to Restore TCJA Full Bonus Depreciation – 3/6/25)

- “Not being able to fully deduct the cost of investment means companies effectively end up paying taxes on profits that do not exist. In the 10-year asset example, depreciation prevents the company from deducting more than 20 percent of its real costs.” (Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25)

- “Permanent improvements to investment incentives will deliver permanent improvements to the level of investment and output in the United States.”

(Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25)

AMERICANS SUPPORT KEEPING THE TCJA AND ITS SMALL BUSINESS TAX POLICIES IN PLACE

- An April 2025 NFIB poll found that Americans are overwhelmingly supportive of keeping the 20% small business tax deduction and understand its importance to Main Street:

- 62% of Americans support keeping the 199A tax deduction, also known as the small business tax deduction, in the tax code.

- “77% agree that the Small Business Tax Deduction helps level the playing field for small businesses…”

- “79% of Americans believe the Small Business Tax Deduction has a positive impact on the economy overall.”

- 95% of Americans “express some concern about the impact an expiration of the deduction would have.” (NFIB: New Polling Shows Strong Support for 20% Small Business Tax Deduction – 4/7/25)

- In another poll, 74% of American voters said not extending the TCJA would hurt small businesses. (New York Post: More than 8 in 10 voters support keeping Trump’s 2017 tax cuts: poll – 5/5/25)

- “80% of potential voters said it was not ideal to increase taxes — up four percentage points from September — and a mere 3% said it was a good time for an increase.” (New York Post: More than 8 in 10 voters support keeping Trump’s 2017 tax cuts: poll – 5/5/25)

SENATE REPUBLICANS ARE WORKING TO MAKE THE TCJA PERMANENT, WHICH WOULD INCREASE LONG-RUN GDP, CREATE MILLIONS OF JOBS, AND AVOID A CRIPPLING TAX INCREASE

“[I]f we don’t extend the Tax Cuts and Jobs Act, small businesses will face a $600 billion tax hike in 2026. Republicans do not intend to let that happen. But we don’t just want to extend the TCJA’s provisions. We want to give small businesses certainty by making these pro-growth tax policies permanent. – Senate Majority Leader John Thune (R-S.D.)

“Our conference is united in preventing an over-$4 trillion tax hike on American families and businesses and delivering additional tax relief to those who have suffered under four years of inflation. We are united in making this proven tax policy permanent to provide the certainty that businesses need to make the long-term investments that drive growth and the stability that families need as they save and plan for the future.” – Senate Finance Committee Chairman Mike Crapo (R-Idaho)

- According to the NFIB, a permanent extension of the small business tax deduction would create 1.2 million jobs annually over the first ten years, growing to 2.4 million per year in the long run. (EY on Behalf of the NFIB: Macroeconomic impacts of permanently extending the Section 199A deduction on small businesses – Sept. 2024)

- The Tax Foundation estimates that making the TCJA permanent would increase GDP in the long run by 1.1%. (Tax Foundation: Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations – 5/7/24)

- If the small business tax deduction is allowed to expire, “taxes will increase on over 30 million small businesses at the end of 2025.” (NFIB: Small Businesses Praise Reintroduction of the Main Street Tax Certainty Act – 1/23/25)

- According to the 2024 NFIB Tax Survey, “61 percent of small business owners reported they would likely raise prices, and 44 percent would postpone or cancel capital investments” if the TCJA expires. (NFIB Research Center: 2024 NFIB Tax Survey – accessed 5/5/25)

Next Previous