10.22.25

The Real Cause of High Health Care Costs? Obamacare

Since Obamacare Became Law, Premiums Have Been Steadily Increasing. Democrats’ Government Subsidies Did Nothing but Shift More Costs to Taxpayers and Enrich Big Insurance Companies

THANKS TO OBAMACARE, PREMIUM COSTS HAVE BEEN RISING FOR YEARS

- “Democrats are panicking about a looming 75% average increase in the out-of-pocket cost of insurance premiums next year for the roughly 6% of the population that shops for coverage on Obamacare’s exchanges. Their panic led them to shut down the government at the end of September.” (Forbes: How Obamacare Set In Motion Today’s Premium Crisis – 10/14/25)

- “The real problem is that the Affordable Care Act was never actually affordable.” (The Washington Post: Editorial: The shutdown conversation no one wants – 10/5/25)

- “Supporters of Obamacare promised that the legislation would cut family premiums by $2,500. Instead, its mix of mandates and pricing restrictions sharply increased individual market premiums.” (Paragon Health Institute: Holding Firm on the COVID Credits, Subsidizing Unauthorized Immigrants’ Health Care, and a Part D Policy Brief – 10/15/25)

- After Obamacare went into effect, “[p]remiums for individual market coverage soared, with average premiums increasing from $242 to $589 — a 143 percent increase — between 2013 and 2019. Deductibles also skyrocketed.” (Paragon Health Institute: Reality Check: The Increasing Cost of Papering Over Obamacare’s Problems – 3/31/22)

-

- 2024: “Family premiums for employer-sponsored health insurance rose 7%... This marks the second year in a row that premiums are up 7%. Over the past five years—a period of high inflation (23%) and wage growth (28%)—the cumulative increase in premiums has been similar (24%).” (KFF: Annual Family Premiums for Employer Coverage Rise 7% to Average $25,572 in 2024, Benchmark Survey Finds, After Also Rising 7% Last Year – 10/9/24)

-

- 2025: “[T]he cost of employer-provided health insurance, which rose 7% in 2024 for a second straight year, is likely to rise again. Companies’ total health-benefit cost for an employee is expected to increase an average of 5.8% in 2025...” (The Wall Street Journal: Health Costs and Flat Raises Are Set to Squeeze Paychecks – 10/14/24)

- “In other words, Obamacare has been an engine of insurance premium inflation. Democrats have tried to cover up that fact with ever more taxpayer subsidies.” (Forbes: How Obamacare Set In Motion Today’s Premium Crisis – 10/14/25)

EXTENDING DEMOCRATS’ COVID-ERA SUBSIDIES HAS NOT AND WILL NOT PREVENT PEOPLE FROM HAVING TO PAY MORE

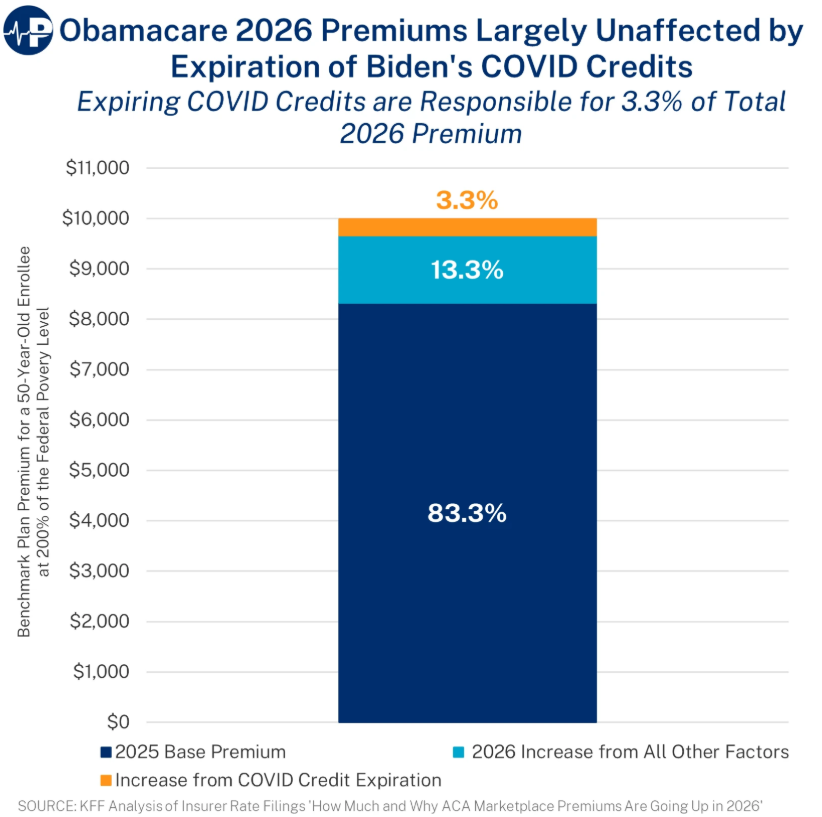

- “Expiration of the Biden COVID Credits is not the primary driver of skyrocketing ACA plan premiums and overall unaffordability.” (Paragon Health Institute: Obamacare 2026 Premiums Largely Unaffected by Expiration of Biden’s COVID Credits – accessed 10/22/25)

- “[T]he expiration of Biden’s COVID Credits, a temporary pandemic measure enhancing subsidies for ACA enrollees, accounts for only 4 percent of the expected 20 percent average premium increase next year.”

(Paragon Health Institute: Obamacare 2026 Premiums Largely Unaffected by Expiration of Biden’s COVID Credits – accessed 10/22/25)

- “More subsidies will not stop premiums from growing. They’ll simply give policymakers cover for refusing to deal with the problem.” (Forbes: How Obamacare Set In Motion Today’s Premium Crisis – 10/14/25)

- “In other words, the sharp jump in premiums cannot be blamed on the phase-out of the enhanced subsidies. The real drivers are the same structural flaws that have plagued Obamacare since 2014 and rising health care costs.” (Paragon Health Institute: Obamacare 2026 Premiums Largely Unaffected by Expiration of Biden’s COVID Credits – accessed 10/22/25)

- “The question now is not whether premiums are rising—they are—but why and who pays the bill. Under the COVID credits, the federal government has been paying 93 percent of the premium for the typical enrollee.” (Paragon Health Institute: Obamacare 2026 Premiums Largely Unaffected by Expiration of Biden’s COVID Credits – accessed 10/22/25)

-

- “Even after the COVID Credits expire, the federal government will still cover more than 80 percent of the typical enrollee’s premium through the regular subsidy. Taxpayers, not consumers, will remain the overwhelming source of revenue for insurers selling ACA exchange plans.” (Paragon Health Institute: Obamacare 2026 Premiums Largely Unaffected by Expiration of Biden’s COVID Credits – accessed 10/22/25)

THE BIGGEST WINNER OF DEMOCRATS’ ATTEMPT TO IMPLEMENT GOVERNMENT-RUN HEALTH CARE? INSURANCE COMPANIES

- Back in 2021, when creating these temporary taxpayer-funded subsidies, Democrats said they “represent the most significant expansion of the Affordable Care Act since it was passed, and perhaps the only expansion politically possible. With an evenly divided Senate, they note, there is very little chance of passage for a more fundamental restructuring, like Medicare for All.” (The New York Times: Pandemic Relief Bill Fulfills Biden’s Promise to Expand Obamacare, for Two Years – 6/17/21)

- As was correctly predicted at the time, “The true plan is to continue to chip away at private health insurance, creating more market dysfunction that they will later claim to solve with more government insurance.” (The Wall Street Journal: Editorial: Supersizing ObamaCare Subsidies – 2/24/21)

- Creating the COVID subsidies was an attempt to “address one of the most persistent complaints about the law among customers and political opponents alike: sky-high premiums for people who don't qualify for federal tax credits to help pay them.” (NBC News: Obamacare would get a big (and quiet) overhaul in the Covid relief bill – 3/2/21)

- “Instead of making the underlying product better or less expensive, Democrats now want to pass more of the cost onto taxpayers.” (The Wall Street Journal: Editorial: Supersizing ObamaCare Subsidies – 2/24/21)

- “Taxpayers now cover 80 percent of the cost of Obamacare plans. The program’s cost surged from $51 billion to $110 billion between 2020 and 2024.” (City Journal: Florida’s Obamacare Fraud Boom – 10/17/25)

- The biggest winners in Democrats’ attempts to paper over Obamacare’s failures have been insurance companies:

- “[T]op lobbying groups representing insurers, hospitals and doctors have all endorsed the [enhanced subsidies], which would pump more money into the system without asking them to cut costs or pay new taxes.” (NBC News: Obamacare would get a big (and quiet) overhaul in the Covid relief bill – 3/2/21)

-

- “The more generous subsidies will be captured by insurers, who will continue to raise premiums, and the specter of high costs will push lawmakers to intervene again. Rinse, repeat.” (The Wall Street Journal: Editorial: Supersizing ObamaCare Subsidies – 2/24/21)

-

- “Roughly 40 percent of enrollees with a fully subsidized, extremely low cost-sharing plan filed no claims in 2024—double the percentage from three years earlier.” (Paragon Health Institute: Don’t Believe AHIP – Improper and Phantom Obamacare Enrollees Are Both Major Problems – 8/20/25)

-

- “In 2024, insurers were likely sent more than $40 billion in subsidies for people who received no health care.” (Paragon Health Institute: Don’t Believe AHIP – Improper and Phantom Obamacare Enrollees Are Both Major Problems – 8/20/25)

REPUBLICANS, MEANWHILE, ARE TAKING STEPS TO ACTUALLY IMPROVE HEALTH CARE QUALITY AND COSTS FOR AMERICAN FAMILIES

- Thanks to Republicans’ One Big Beautiful Bill Act, “more people will be able to benefit from the triple tax-advantaged health savings account, or HSA,” “enabling millions more enrollees to open and contribute to HSAs without having to change insurance plans.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25; White House: Expansion of HSA Eligibility Under OBBB Act to Improve Marketplace Coverage, Affordability, and Access – 9/26/25)

- “Health savings accounts, or HSAs, let those with high-deductible health plans set aside pre-tax money for medical expenses — from Advil and X-rays to doctor’s visits. They’re widely considered one of the most powerful long-term savings tools…” (The Hill: What to know about HSAs during open enrollment season – 10/22/25)

- “HSA plans are a favorite savings vehicle among financial advisers because contributions are tax-free, money grows tax-free, and if used for a qualifying expense, withdrawals are tax-free.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25)

- “The HSA changes made in the law ‘represent the most significant HSA expansion in nearly two decades,’ according to health and benefits platform Lively.” (USA Today: A favorite savings tool of financial advisers gets better with 'One Big Beautiful Bill' – 8/9/25)

- In addition to expanding access to HSAs, Republicans’ One Big Beautiful Bill Act also makes numerous improvements to Americans’ health care:

- Excludes certain orphan drugs used for rare diseases from Democrats’ price setting scheme, “preserv[ing] incentives for developing treatments for rare diseases,” which are “particularly vulnerable to unintended consequences from government price controls.” (Paragon Health Institute: What Made It Into Law: Health Provisions of the One Big Beautiful Bill – 7/10/25)

-

- Increases federal payments to doctors via authorizing a 2.5% adjustment to the Medicare Physician Fee Schedule payment rate for 2026.

- Prioritizes government health spending on American citizens.

- Strengthens verification requirements and prevents subsidy abuse during Special Enrollment periods.

- Removes the cap on the IRS’s ability to recapture improper advanced premium tax credit payments during tax reconciliation.

- Allows individuals with HSA-eligible plans to access telehealth services without a deductible, by making the CARES Act telehealth safe harbor permanent.

- Establishes a Rural Health Transformation Program to support rural health systems and hospitals with a $50 billion investment over five years. (U.S. Congress: H.R.1 - One Big Beautiful Bill Act – accessed 10/22/25)

Next Previous