‘Undeniable Math’

‘Most People Are Going To Pay Less’ In Federal Income Taxes

TAX EXPERTS: ‘Most People Are Going To Pay Less’

“…the undeniable math is that most people are going to pay less.” (“The Daily 202: The Tax Bill Is Likely To Become More Popular After Passage. Here’s How Republicans Plan To Sell It.,” The Washington Post, 12/20/2017)

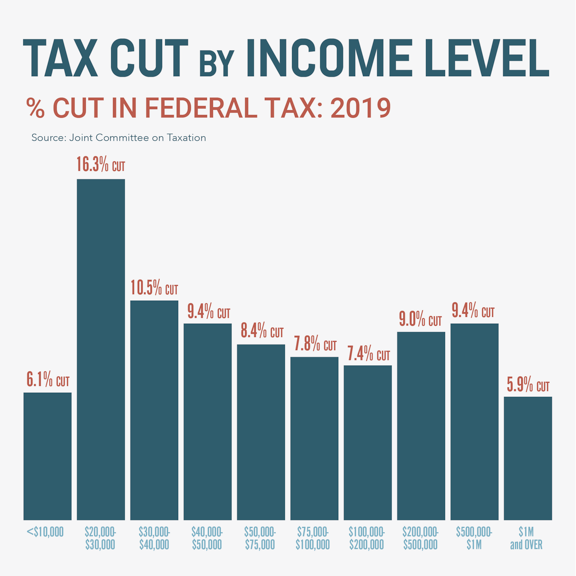

JOINT COMMITTEE ON TAXATION

Non-Partisan TAX FOUNDATION: ‘We’ve Run The Taxes Of Eight Example Households… Our Results Indicate A Reduction In Tax Liability For Every Scenario’

TAX FOUNDATION: “To help provide a sense of how the Tax Cuts and Jobs Act would impact real taxpayers, we’ve run the taxes of eight example households. Each sample taxpayer has realistic characteristics to show how the individual income tax provisions of the bill would impact individuals and families across the income spectrum. Our results indicate a reduction in tax liability for every scenario we estimated, with some of the largest changes in after-tax income accruing to moderate-income families with children.” (“Who Gets A Tax Cut Under The Tax Cuts And Jobs Act?” Tax Foundation, 12/19/2017)

- EXAMPLE: “a single-earner married couple with two kids, earning $85,000. We assume tax-deferred retirement savings of $5,500, and that the couple takes the standard deduction. They also benefit from the expanded child tax credits, and see an overall tax savings of 20 percent, from $11,035 to $8,782. This family’s after-tax income increases by 2.65 percent.” (“Who Gets A Tax Cut Under The Tax Cuts And Jobs Act?” Tax Foundation, 12/19/2017)

- EXAMPLE: “A dual-income household with three children, this household sees incomes of $250,000 and $75,000 respectively, with an $800,000 home (same assumptions as above), charitable contributions of 2.5 percent of income, an effective state and local income tax rate of 5 percent, and a slightly higher effective property tax rate of 1.25 percent. The couple has $37,000 in retirement contributions (maxing out 401(k)s under current law in 2018), and is ineligible for child tax credits under current law, but eligible under the Tax Cuts and Jobs Act. Their tax liability would decrease by 13 percent under the plan, from $71,629 to $62,012. Their after-tax income increases by 2.96 percent.” (“Who Gets A Tax Cut Under The Tax Cuts And Jobs Act?” Tax Foundation, 12/19/2017)

‘Left-Leaning’ TAX POLICY CENTER: ‘We Find The Bill Would Reduce Taxes On Average For All Income Groups’

TAX POLICY CENTER: “The Tax Policy Center has released distributional estimates of the conference agreement for the Tax Cuts and Jobs Act as filed on December 15, 2017. We find the bill would reduce taxes on average for all income groups in both 2018 and 2025.” (“Distributional Analysis Of The Conference Agreement For The Tax Cuts And Jobs Act,” Tax Policy Center, 12/18/2017)

- TPC: “Compared to current law, taxes would fall for all income groups on average in 2018, increasing overall average after-tax income by 2.2 percent.” (“Distributional Analysis Of The Conference Agreement For The Tax Cuts And Jobs Act,” Tax Policy Center, 12/18/2017)

- TPC: “In 2018, 80 percent of taxpayers would receive a tax cut from the included provisions—averaging about $2,100 …” (“Distributional Analysis Of The Conference Agreement For The Tax Cuts And Jobs Act,” Tax Policy Center, 12/18/2017)

‘In The Middle Income Quintile, 91 Percent Would Receive A Tax Cut’

TAX POLICY CENTER: “In the middle income quintile, 91 percent would receive a tax cut …” (“Distributional Analysis Of The Conference Agreement For The Tax Cuts And Jobs Act,” Tax Policy Center, 12/18/2017)

- “Taxpayers in the middle income quintile (those with income between about $49,000 and $86,000) would receive an average tax cut of about $900, or 1.6 percent of after-tax income.” (“Distributional Analysis Of The Conference Agreement For The Tax Cuts And Jobs Act,” Tax Policy Center, 12/18/2017)

WALL STREET JOURNAL: “The Tax Policy Center is a joint project of the left-leaning Brookings Institution and the Urban Institute that the media routinely labels ‘nonpartisan.’ Its record of hostility to any GOP tax reform that cuts tax rates shows the opposite.” (Editorial, “Tax Policy Center Propaganda,” Wall Street Journal, 10/1/2017)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Small Business, Economy, Jobs, Middle Class, Taxes, Tax Reform

Next Previous