American Families Find No Relief From Biden’s Persistent Inflation

The September Inflation Report Shows ‘Prices Continue To Surge, A Sign That Persistent Cost Increases Are Becoming Entrenched,’ ‘Intensifying Pressure On Households, Wiping Out Pay Gains,’ And ‘Causing Hardships For Many And Deepening Pessimism About The Economy’

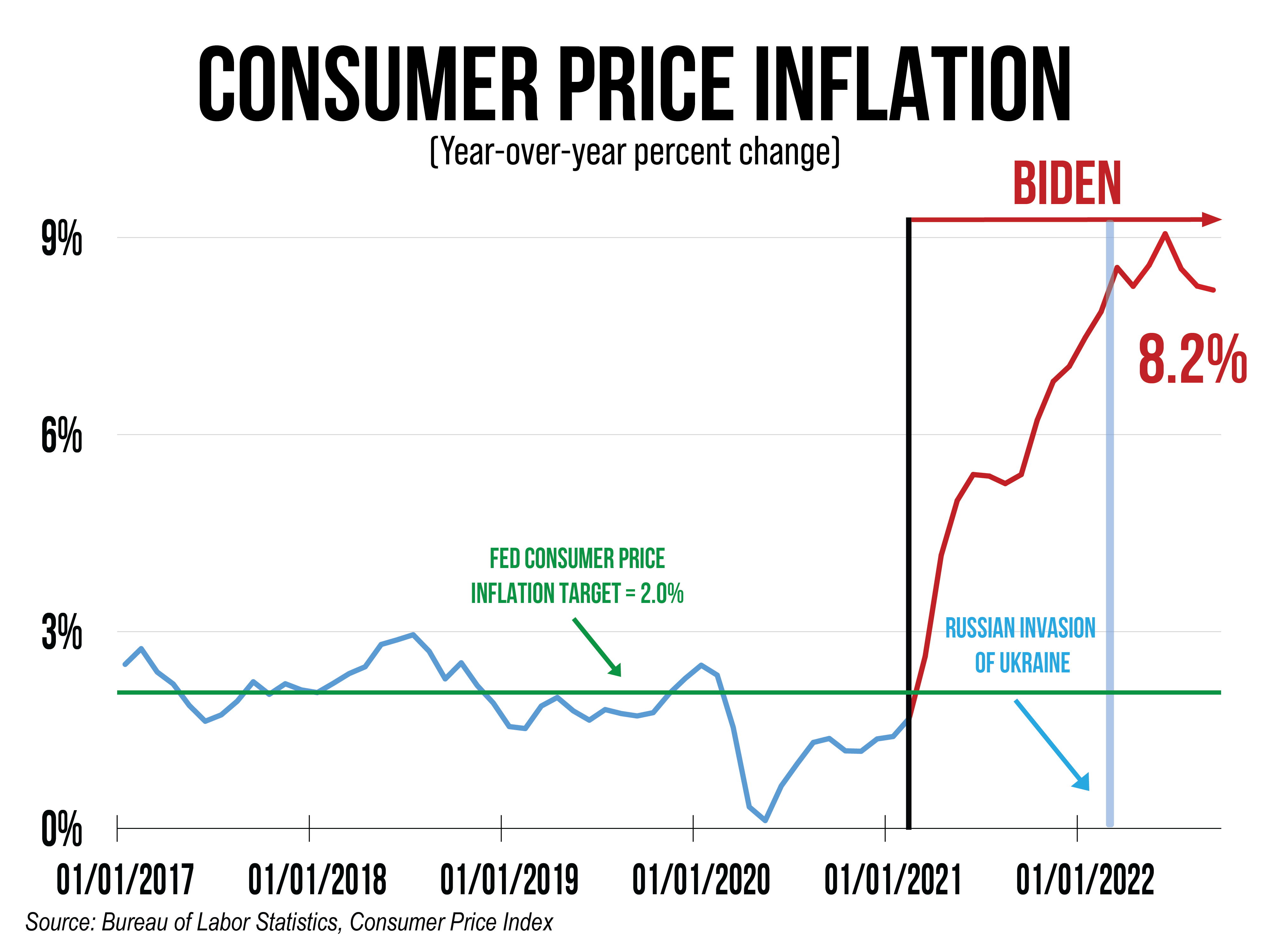

SEN. MIKE CRAPO (R-ID), Senate Finance Committee Ranking Member: “At 8.2 percent, inflation continues to hammer American families and eat away at their paychecks. Consumer price inflation has been above eight percent for seven consecutive months, reflecting the reckless and irresponsible spending policies of the current administration. It is now left to the Federal Reserve to dampen inflationary pressures, which means higher interest rates for families needing a mortgage or credit, and higher interest costs to service the federal government’s runaway debt. Before the shock of the pandemic, Republican policies led to low inflation, low unemployment, and robust growth. Now, the economic mismanagement by the Biden Administration has families dipping into savings to afford everyday necessities.” (U.S. Senate Finance Committee Ranking Member, Press Release, 10/13/2022)

SEN. JOHN BARRASSO (R-WY): “High prices are not transitory – they have become entrenched in our economy. In under two years, Democrats have taken us from nonexistent inflation to a 40-year record high. Too many Americans are living the nightmare of having to choose between buying gas they can’t afford, buying groceries they can’t afford, and paying energy bills they can’t afford. Families are struggling under the Democrats’ radical agenda.” (Sen. Barrasso, Press Release, 10/13/2022)

SEN. KEVIN CRAMER (R-ND): “With CPI clocking in at 8.2%, Americans feel like they’re stuck in a bad saga of Groundhog Day. Every day Democrats try to convince us their tax and spend policies are helping, but every month the pain of inflation sticks around.” (Sen. Cramer, @SenKavinCramer, Twitter, 10/13/2022)

SEN. JOHN CORNYN (R-TX): “As predicted, the Democrats’ ‘Inflation Reduction Act’ did not reduce inflation.” (Sen. Cornyn, @JohnCornyn, Twitter, 10/13/2022)

‘US Inflation Pressures Further Intensified In September’ As Core Inflation ‘Accelerated To A New Four-Decade High’

(U.S. Senate Finance Committee Ranking Member, Press Release, 10/13/2022)

“Inflation in the United States accelerated in September, with the cost of housing and other necessities intensifying pressure on households, wiping out pay gains that many have received and ensuring that the Federal Reserve will keep raising interest rates aggressively. Consumer prices rose 8.2% in September compared with a year earlier, the government said Thursday. On a month-to-month basis, prices increased 0.4% from August to September after having ticked up 0.1% from July to August.” (“US Inflation Pressures Further Intensified In September,” The Associated Press, 10/13/2022)

“U.S. consumer inflation excluding energy and food accelerated to a new four-decade high in September as prices continued to surge, a sign that persistent cost increases are becoming entrenched in the economy. The Labor Department on Thursday said that the so-called core measure of the consumer price index—which excludes volatile energy and food prices—gained 6.6% in September from a year earlier, up from 6.3% in August. That marked the biggest increase since August 1982.” (“Inflation Sits at 8.2% as Core Prices Hit Four-Decade High,” The Wall Street Journal, 10/13/2022)

September marked the SEVENTEENTH consecutive month in which inflation rose at least 5 percent. (Bureau of Labor Statistics, Accessed 10/13/2022)

- September also marked the TENTH consecutive month in which inflation rose at least 7 percent. (Bureau of Labor Statistics, Accessed 10/13/2022)

“Inflation has swollen families’ grocery bills, rents and utility costs, among other expenses, causing hardships for many and deepening pessimism about the economy …” (“US Inflation Pressures Further Intensified In September,” The Associated Press, 10/13/2022)

Prices For Goods And Services Essential To Everyday Life Continued To Fuel Inflation

“[P]rices for housing, medical care, food and other items have continued to increase, threatening to keep inflation higher for longer. Housing costs rose by the most since the early 1980s, as a strong labor market continues to push up rental rates. Housing makes up the largest share of the overall and core indexes.” (“Inflation Sits at 8.2% as Core Prices Hit Four-Decade High,” The Wall Street Journal, 10/13/2022)

“Higher prices for many services — health care, auto repair and housing, among others — drove inflation last month. The cost of eyeglasses and eye care, for example, jumped 3.2% from August to September, the sharpest one-month increase on records.” (“US Inflation Pressures Further Intensified In September,” The Associated Press, 10/13/2022)

“The latest inflation report was driven by increased costs for shelter, medical care, health insurance, new vehicles, home furnishings and education. Higher prices in those categories have all persisted for months …” (“Prices Rose Again In September; Markets Poised To Tumble On Sign Of Higher Interest Rates,” The Washington Post, 10/13/2022)

“Rent remains one of the most significant slices of the inflation report, known as the consumer price index. Rent costs rose 0.8 percent in September, up slightly from the previous two months. It is also up 7.2 percent in the past year, marking the largest increase since 1982.” (“Prices Rose Again In September; Markets Poised To Tumble On Sign Of Higher Interest Rates,” The Washington Post, 10/13/2022)

“The food index rose 0.8 percent in September, as it did in August. Fruits and vegetables were up 1.6 percent, and cereals and bakery goods were up 0.9 percent. Flour, turkey and butter hit new highs. All told, food costs are up 11.2 percent over the past year.” (“Prices Rose Again In September; Markets Poised To Tumble On Sign Of Higher Interest Rates,” The Washington Post, 10/13/2022)

Candy Prices Will Be One Of The Spookiest Things For Families This Halloween

“Giving out treats this Halloween will be a lot more expensive than usual. The cost of candy and chewing gum jumped 13.1% in September from last year, the most ever, according to the latest US inflation data. This comes just before what’s arguably candy’s most important holiday — Halloween.” (“Cost of Candy Soars by Record 13.1% Right Before Halloween,” Bloomberg, 10/13/2022)

Meanwhile, Americans Continue Giving Up More Of Their Paychecks To Inflation, With Year-On-Year Real Average Weekly Earnings Decreasing 3.8%

“Real average hourly earnings decreased 3.0 percent, seasonally adjusted, from September 2021 to September 2022. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.8-percent decrease in real average weekly earnings over this period.” (Bureau of Labor Statistics, Press Release, Accessed 10/13/2022)

Since President Biden Took Office, Prices For Food, Energy, Transportation And Housing Have Increased At Staggering Rates

Since President Biden became president, inflation has increased 13.5%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Grocery (food at home) prices have increased 18%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Food away from home prices have increased 12%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Energy prices have increased 45%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Gasoline (all types) prices have increased 59%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Natural gas prices have increased 52%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Electricity prices have increased 23%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Rental prices for a primary residence have increased 9%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Prices for used cars and trucks have increased 36%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Prices for new vehicles have increased 17%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Furniture prices have increased 22%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Apparel prices have increased 10%. (Bureau of Labor Statistics, Accessed 10/13/2022)

- Airline fares have increased 42%. (Bureau of Labor Statistics, Accessed 10/13/2022)

Home Mortgage Rates Just Hit ‘A 20-Year High,’ ‘Putting Homeownership Out Of Reach For Many’

“U.S. mortgage rates jumped to their highest level in more than two decades. The average 30-year fixed mortgage rate hit 6.92% this week, according to a survey of lenders released Thursday by mortgage giant Freddie Mac. Many lenders are offering rates well over 7%. A year ago, the average rate was 3.05%. The most recent jump, from 6.66% a week ago, took the rate above the peak of the last financial crisis. The benchmark has climbed nearly 2 percentage points since August, adding to an already brisk rise since the Federal Reserve began lifting rates earlier this year. The latest climb has been particularly painful for the housing market, putting homeownership out of reach for many would-be buyers because of the added monthly cost of paying a mortgage at a higher rate.” (“Mortgage Rates Hit 6.92%, a 20-Year High,” The Wall Street Journal, 10/13/2022)

- “A buyer that earns the median household income and puts 20% down could afford a home costing $343,000 this week. That buyer could have afforded a home costing almost $449,000 in January, according to listings website Realtor.com, which is operated by Wall Street Journal parent company News Corp. The median existing home cost $389,500 in August.” (“Mortgage Rates Hit 6.92%, a 20-Year High,” The Wall Street Journal, 10/13/2022)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Economy, Inflation

Next Previous