Obamacare: ‘Rural Shoppers Face Slim Choices, Steep Premiums’

MN Dem Gov: ‘The Reality Is The Affordable Care Act Is No Longer Affordable’

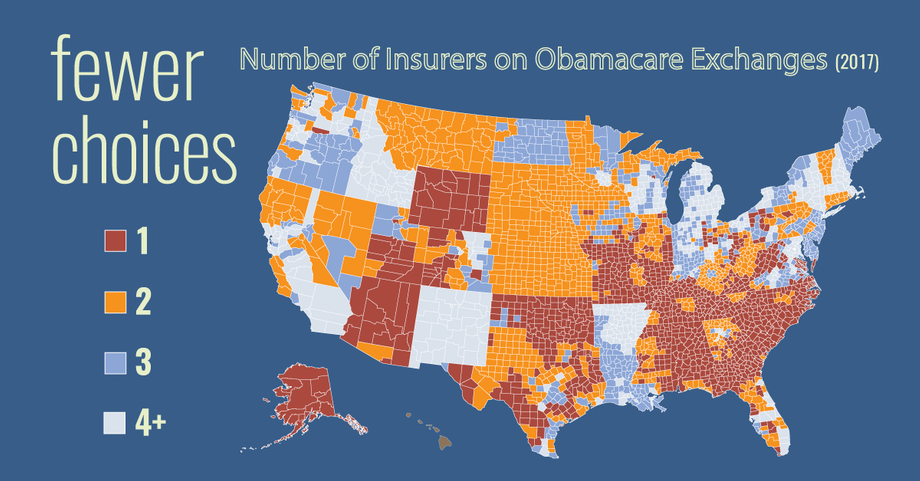

2018: “With the latest departures, more than 40 percent of U.S. counties would have only one insurer selling coverage on their marketplaces for next year, according to data compiled by The Associated Press and the consulting firm Avalere.” (“More Price Hikes Likely For Government Insurance Markets,” AP, 5/11/2017)

2017: “People living in sparsely populated areas who shopped for coverage on the state health insurance marketplaces in 2017 frequently had just one or two insurers from which to pick and often faced significantly higher premiums than did people in more urban areas, according to a new study.” (“Rural Shoppers Face Slim Choices, Steep Premiums On Exchanges,” Kaiser Health News, 5/12/2017)

- “This year, about a third of the country’s population live in areas where just one or two insurers sold policies on these ACA marketplaces, the analysis by researchers at the Urban Institute found. That included four states … as well as rural areas of several others.” (“Rural Shoppers Face Slim Choices, Steep Premiums On Exchanges,” Kaiser Health News, 5/12/2017)

- “In regions with just one insurer, monthly premiums were $451 or higher in half of the silver ‘benchmark’ plans on which premium subsidies are based.” (“Rural Shoppers Face Slim Choices, Steep Premiums On Exchanges,” Kaiser Health News, 5/12/2017)

MINNESOTA: Dem. Governor: ‘The Reality Is The Affordable Care Act Is No Longer Affordable’

“Minnesota's Democratic governor said Wednesday that the Affordable Care Act is ‘no longer affordable’ for many, a stinging critique from a state leader who strongly embraced the law and proudly proclaimed health reform was working in Minnesota just a few years ago.” (“Democrat Dayton: Health Law 'No Longer Affordable' For Many,” The Associated Press, 10/12/2016)

- “‘The reality is the Affordable Care Act is no longer affordable for increasing numbers of people,’ Dayton said...” (“Democrat Dayton: Health Law 'No Longer Affordable' For Many,” The Associated Press, 10/12/2016)

“[S]ome Minnesotans who [once] used MCHA [Minnesota’s old high-risk poll] are now seeing even higher premiums in the volatile market under the ACA.” (“The Future After ACA? Look To Minnesota's Past,” StarTribune, 2/14/2017)

- “Health plans in Minnesota’s individual market have much tighter networks this year to reduce costs. Plans sold throughout most of the state, for example, don’t include the Mayo Clinic as an in-network provider, even though survey data from 2013 showed that 38 percent of MCHA beneficiaries said access to Mayo was ‘extremely important.’” (“The Future After ACA? Look To Minnesota's Past,” StarTribune, 2/14/2017)

Minnesota Woman: “Mairi Doerr of Cannon Falls … relied on MCHA for 30 years…. Although her MCHA rates had increased steadily over the years, it was nothing like the premium increases she has seen in the individual market since the ACA took effect. One year after she made the switch, her 2016 monthly premium jumped 45 percent to about $750. This year, she faced another huge increase, to $1,300 a month.” (“The Future After ACA? Look To Minnesota's Past,” StarTribune, 2/14/2017)

- “Doerr never thought she would look back on the day when her MCHA rates looked reasonable. ‘I was astounded,’ Doerr said.” (“The Future After ACA? Look To Minnesota's Past,” StarTribune, 2/14/2017)

Minnesota Senior: “The last year [Dave] Wiest purchased coverage through MCHA, he was 64 years old and his premium as a Hennepin County resident was about $540 per month. The coverage featured a $3,000 annual limit on total out-of-pocket expenses. Now … as an insurance agent, he follows consumers who are buying insurance through Minnesota’s individual market. For 2017, he said, a 64-year-old in Hennepin County is paying more than $1,100 per month, for a policy that requires $3,600 in out-of-pocket spending. What’s more, compared to MCHA it’s an inferior plan, he said, with a much more limited network of doctors and hospitals.” (“The Future After ACA? Look To Minnesota's Past,” StarTribune, 2/14/2017)

Minnesota Small Business Owner: “[Dirk Bak’s] business, SDQ Janitorial in Minnetonka, Minn., has been family-owned for 34 years and had been offering its nearly 200 full-time workers coverage even before the ACA became law. ‘We saw, two years ago, a dramatic price increase for our premiums,’ Bak says, adding that the hike was over 30 percent in one year.” (“Small-Business Owners Are Full Of Questions And Regrets About The End Of Obamacare,” CNBC, 2/28/2017)

PENNSYLVANIA: In 2017 Rates Went Up 53%; ‘Who Can Afford That?’

“In Pennsylvania, one of 37 states that use the federal government's online exchange, the average price for the benchmark silver plan is going up 53 percent, according to a recent report from the U.S. Department of Health and Human Services.” (“With Obamacare Options Slim In The Lehigh Valley, Many Feel Priced Out Of Health Coverage,” The [Allentown, PA] Morning Call, 11/05/2016)

Pennsylvania Retiree: “Richard Dean of Bethlehem Township, said he can no longer afford insurance on Healthcare.gov. The retired bank employee said . . . though he has health insurance through retirement benefits, his wife does not. For 2016, Dean found separate coverage for his wife on the exchange. But that plan, which cost $572 a month, is to be discontinued next year and the nearest equivalent he can find would be $917 a month, or $11,004 a year, he said. The deductible would also go up, to $6,800 from $4,500; and after meeting the deductible, the co-insurance would be 30 percent — meaning his wife would still have to pay 30 percent of her bills. ‘I’m praying this is a mistake,’ he said. ‘Who can afford that?’” (“With Obamacare Options Slim In The Lehigh Valley, Many Feel Priced Out Of Health Coverage,” The [Allentown, PA] Morning Call, 11/05/2016)

- “Dean said his wife might have to go without any coverage — a move that, adding insult to injury, would trigger a tax penalty. He said the Affordable Care Act doesn't seem to be living up to its name. ‘This is a nightmare,’ he said. ‘If you go look up the word “affordable,” by any means this is not affordable.’” (“With Obamacare Options Slim In The Lehigh Valley, Many Feel Priced Out Of Health Coverage,” The [Allentown, PA] Morning Call, 11/05/2016)

Pennsylvania Father: “Obamacare used to work for Kelvin Smith. Even though his income as a self-employed computer programmer was too high for government subsidies, he could still use its online exchange to buy insurance for his family. But that was before the current open enrollment period, which started last week. Smith has since learned his insurance plan, along with most others on Healthcare.gov, will be discontinued next year, and that the only comparable plans remaining are well outside his price range.” (“With Obamacare Options Slim In The Lehigh Valley, Many Feel Priced Out Of Health Coverage,” The [Allentown, PA] Morning Call, 11/05/2016)

- “‘Essentially, we'd be paying $25,000 and getting very little out of it,’ said Smith, who is married and has two boys, 8 and 6. Out-pocket-costs including for medication to treat his younger son's allergies mean the actual expense would be closer to $30,000 a year, or nearly a third of his annual income. ‘We’ve got to figure something out,’ he said, a note of desperation in his voice.” (“With Obamacare Options Slim In The Lehigh Valley, Many Feel Priced Out Of Health Coverage,” The [Allentown, PA] Morning Call, 11/05/2016)

NEW MEXICO: In 2016 One Insurer ‘Allowed To Increase Rates 93%’, In 2018 Insurers Remain Undecided About Obamacare Participation

“In New Mexico, the Blue Cross Blue Shield plan agreed to resume selling plans through the online exchanges after sitting out last year, but has been allowed to increase rates 93% on their 2015 level.” (“Rate Increases For Health Plans Pose Serious Test For Obama’s Signature Law,” Wall Street Journal, 10/18/16)

“Health insurers in New Mexico are busy crunching the numbers they need to price premium rates for this coming year…. Blue Cross Blue Shield of New Mexico has not made a final decision about its 2018 exchange market participation or product offerings…. Molina Healthcare, which has Medicare and Medicaid customers in New Mexico, is also evaluating its options for staying or pulling out of the Obamacare exchanges in 2018.” (“NM: Insurers Can Submit Two Rate Requests,” Albuquerque Journal, 5/22/2017)

###

SENATE REPUBLICAN COMMUNICATIONS CENTER

Related Issues: Obamacare, Health Care

Next Previous