06.10.25

Republicans’ Reconciliation Bill Means Prosperity for Small Businesses and Manufacturers

The Tax Cuts and Jobs Act Unleashed a Flurry of Business Development and Expansion. Senate Republicans Are Working to Make These Provisions Permanent for Main Street Businesses and Manufacturers

THE 2017 TAX CUTS AND JOBS ACT HELPED SMALL BUSINESSES AND MANUFACTURERS GROW AND INNOVATE, BUT THOSE PROVISIONS ARE SUNSETTING

- “One of the 2017 tax reform’s most constructive changes was letting businesses immediately deduct the full cost of capital investments rather than spread them out.” (The Wall Street Journal: Editorial: Making a More Beautiful Tax Bill – 6/8/25)

- “Instead of writing off a $100,000 machine over its useful life-span—say, $10,000 a year over 10 years—businesses were allowed to immediately expense the full cost as they do operating costs.” (The Wall Street Journal: Editorial: Making a More Beautiful Tax Bill – 6/8/25)

- “[B]usinesses only get to write off portions of their expenses on capital. This includes purchasing new equipment or building new factories. Those investments are subject to sometimes decades-long depreciation schedules, meaning that businesses are partially taxed on profits they did not make.” (National Review: Editorial: How Republicans Can Make the Tax Bill More Pro-Growth – 6/9/25)

- “Businesses should be able to write off the full cost of their capital expenses in the year they are made, just like they do for labor expenses. That’s called ‘full expensing.’ The TCJA allowed full expensing for some, not all, capital expenses on a temporary basis. That provision began to phase out in 2023…” (National Review: Editorial: How Republicans Can Make the Tax Bill More Pro-Growth – 6/9/25)

- “Companies [in 2022] also had to begin deducting their research and development costs over five years rather than immediately, which upended a decades-old policy. R&D spending has consequently flagged… growing 3.6% annually on average since January 2022 compared with 7.4% in 2018 and 2019 and 8.8% in 2021.” (The Wall Street Journal: Editorial: Making a More Beautiful Tax Bill – 6/8/25)

MAKING THESE PROVISIONS PERMANENT, RATHER THAN SIMPLY EXTENDING THEM, WILL GIVE SMALL BUSINESSES MUCH-NEEDED CERTAINTY AND HELP GROW THE ECONOMY

- “We’re also committed to making other small business tax relief from the Tax Cuts and Jobs Act permanent, like bonus depreciation and the Section 199A deduction… That means more jobs and more opportunities for American workers. It also means an increase in federal revenues – but an increase in federal revenues the right way: by growing and expanding the economy, not raising taxes.” – Senate Majority Leader John Thune (R-S.D.)

- “A temporary extension of these pro-growth and pro-family policies is a missed opportunity. Businesses need certainty while investing in their companies and taxpayers should not fear tax hikes due to Congressional inaction. Congressional Republicans have an historic opportunity to enact this lasting tax relief.” – Nine Republican Senate Finance Committee Members

- “[T]hey need certainty in terms of the ruleset. We can deliver that through this bill; we need to do it quickly. And if we do it quickly, we’ll be able to see a 2026 that’s gonna be an incredible move forward – lots more capital investment, that capital investment begets more employment, that employment and jobs begets more economic activity. It’s a positive feedback loop that will make America grow…” – Sen. Bill Hagerty (R-Tenn.)

- “Tax breaks enacted to help small businesses aren’t permanent” under current law, “and that’s made it difficult for business owners to make long-term decisions.” (CNBC: Small businesses cheer Trump tax reforms, but some feel they didn’t go far enough – 3/18/19)

- According to the White House Council of Economic Advisers, “The total long run effect of both extending low rates and instituting permanent full expensing for equipment and R&D is an investment boost of 4.4 to 6.7 percent, a 1.0 to 1.6 percent higher level of real GDP, and increased wages of $3,955 to $7,031.” (White House: Preserving and Expanding Low Tax Rates to Create American Economic Prosperity – May 2025)

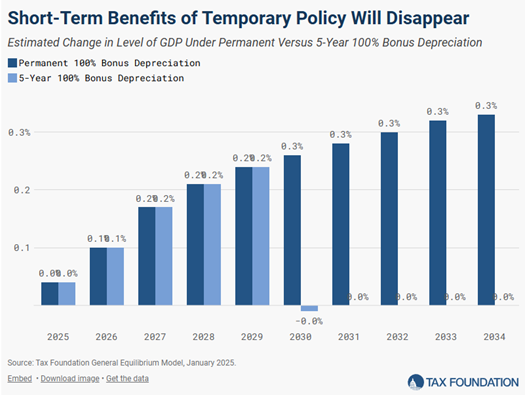

- “Permanent improvements to investment incentives will deliver permanent improvements to the level of investment and output in the United States.”

(Tax Foundation: Expensing: It Pays to Be Permanent – 1/28/25)

SMALL BUSINESSES AND MANUFACTURERS ARE VITAL TO THE ECONOMY, AND AMERICANS SUPPORT EFFORTS TO BOLSTER THEIR COMPETITIVENESS

- “[A]s part of our tax cuts, we want to cut taxes on domestic production and all manufacturing. And just as we did before, we will provide 100% expensing.”– President Donald Trump

- “The TCJA empowered small business owners to invest in themselves through provisions like bonus depreciation, enhanced business expensing, and the R&D deduction. More importantly, the TCJA enabled small businesses to invest more in their employees… When small businesses grow, the American economy grows.” – Senate Small Business and Entrepreneurship Committee Chair Joni Ernst (R-Iowa)

- “Currently, manufacturers in the United States perform 53.9% of all private-sector research and development in the nation, driving more innovation than any other sector.” (Real Clear Energy: The U.S. Senate Can Give American Manufacturers the Certainty They Deserve – 6/5/25)

- The year after the TCJA was passed, wages grew 3.4%, “the fastest pace in nearly a decade and well above inflation.” (The Washington Post: Workers suddenly have more power to demand higher pay and better jobs – 3/8/19)

- Nearly 80% of National Federation of Independent Business (NFIB) members polled in their 2021 Tax Survey report “described the tax law positively, compared to just 8% who had a negative view of the tax law.” (NFIB Research Center: NFIB Tax Survey 2021 – June 2021)

- In another poll, 74% of American voters said not extending the TCJA would hurt small businesses. (New York Post: More than 8 in 10 voters support keeping Trump’s 2017 tax cuts: poll – 5/5/25)

- “80% of potential voters said it was not ideal to increase taxes — up four percentage points from September — and a mere 3% said it was a good time for an increase.” (New York Post: More than 8 in 10 voters support keeping Trump’s 2017 tax cuts: poll – 5/5/25)

- “There is also a belief that tax increases on businesses will lead to higher costs for consumers. 70% of the country believes that if companies have to pay more in taxes, those costs will be passed on to consumers in higher prices,” with only 16% in disagreement. (The Winston Group: Raising Taxes In A Time of Inflation – 5/22/25)

Next Previous