06.09.25

Republicans Will Strengthen Medicaid for Future Generations

After Democrats Recklessly Expanded the Program and Costs Exploded, Republicans Are Rooting Out Waste, Fraud, and Abuse

DEMOCRATS HAVE BEEN EXPANDING THE SCOPE OF MEDICAID FOR DECADES, FINANCIALLY DESTABILIZING IT, AND LEAVING THOSE WHO NEED IT IN JEOPARDY

- “The Biden administration has enacted several major Medicaid rule changes with giant fiscal costs,” including a rule finalized in 2024 that keeps people on Medicaid “when they are no longer eligible,” while restricting the times “when states may verify changes in eligibility.” (Paragon Health Institute: Biden’s Medicaid Changes: High Costs, Misguided Policy – 11/6/24)

- “Per the Congressional Budget Office, federal outlays on the program have been positively soaring, from $409 billion in 2019 to $615 billion in 2023, and projected to hit $655 billion in 2025. That’s a 50% jump from 2019 to 2023, and 60% to 2025.” (The New York Post: Editorial: ‘Deadly’ GOP ‘cuts’ don’t even touch Medicaid’s 50% growth since 2019 – 6/3/25)

- “Over the last decade, Medicaid has outpaced the growth of the other two largest federal entitlement programs: Social Security and Medicare.” (Cato Institute: Medicaid Is Driving Deficits: Republicans Are Scarcely Tapping the Brakes – 5/13/25)

- “You won’t find many voters who think the federal government should focus scarce health resources on working-age men over poor children and pregnant women. Yet that is what the perverse financing formula encourages, as states can grab more federal dollars if they sign up more prime-age adults.” (The Wall Street Journal: The GOP’s Medicaid Moment of Truth – 5/4/25)

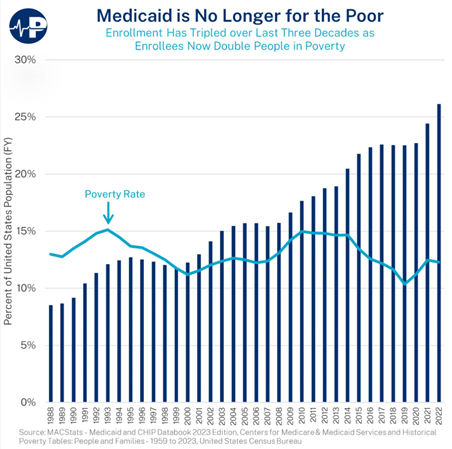

- Medicaid enrollment and costs have exploded:

(Paragon Health Institute: Medicaid is No Longer for the Poor – accessed 6/9/25)

TO MAINTAIN MEDICAID FOR ITS INTENDED RECIPIENTS, REPUBLICANS ARE ROOTING OUT WASTE, FRAUD, AND ABUSE

- “Keep in mind that Medicaid was established to help the needy—poor children, pregnant women, the elderly and disabled.” (The Wall Street Journal: Editorial: Who’s Afraid of Medicaid Reform? – 2/26/25)

- According to the Congressional Budget Office (CBO), Republicans’ reconciliation bill would remove an estimated 1.4 million illegal aliens from state Medicaid programs. (Congressional Budget Office: Letter to Democrat Committee Chairs – 6/4/25)

-

- “[F]ederal dollars are not supposed to finance Medicaid benefits to illegal immigrants, yet 14 states and the District of Columbia cover them anyway.” (National Review: Editorial: Republicans’ Modest Medicaid Changes – 6/5/25)

-

- “The bill would have the federal government send less Medicaid money to those states in order to discourage the practice, or at least ensure that taxpayers in the other 36 states do not foot the bill.” (National Review: Editorial: Republicans’ Modest Medicaid Changes – 6/5/25)

- According to the CBO, Republicans’ reconciliation bill would remove an estimated 1.3 million ineligible recipients currently on Medicaid. (Congressional Budget Office: Letter to Democrat Committee Chairs – 6/4/25)

- Protecting children, people with disabilities, pregnant women, and seniors, Republicans’ reconciliation bill would require able-bodied adults who can work to do so to receive Medicaid benefits. The CBO estimates this work requirement would lead to 4.8 million able-bodied adults forgoing coverage. (Congressional Budget Office: Letter to Democrat Committee Chairs – 6/4/25)

- “Republicans would also impose a new requirement that states obtain addresses from Medicaid enrollees, a bare minimum for stopping fraud.” (National Review: Editorial: Republicans’ Modest Medicaid Changes – 6/5/25)

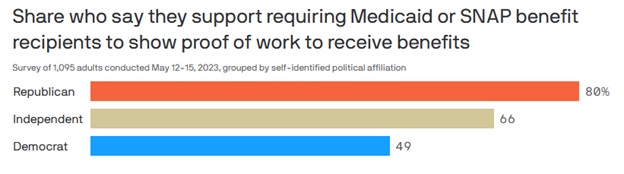

AMERICANS SUPPORT COMMONSENSE WORK REQUIREMENTS FOR MEDICAID

- “78% believe the best way to balance the budget is by holding the line on taxes, cutting wasteful spending, and promoting pro-growth policies—rather than increasing taxes.” (U.S. Chamber of Commerce poll – 3/4/25)

- 62% of Americans support Medicaid work requirements, “which would require nearly all adults to be working or looking for work in order to have health insurance through Medicaid,” including 82% of Republicans and 60% of independents. (Kaiser Family Foundation: KFF Health Tracking Poll February 2025: The Public’s Views on Potential Changes to Medicaid – 3/7/25)

- A 2023 Axios-Ipsos poll found that “[n]early two-thirds of Americans — including half of Democrats — back work requirements for Medicaid and Supplemental Nutritional Assistance Program benefits.”

- “Overall, 63% strongly or somewhat support requiring Medicaid or SNAP recipients to show proof of work to receive benefits. 66% of independents and 49% of Democrats back the policy change, along with 80% of Republicans.”

(Axios: Axios-Ipsos poll: Americans back work requirements for federal aid – 5/18/23)

REPUBLICANS’ RECONCILIATION BILL ALSO CLOSES THE PROVIDER TAX LOOPHOLE, WHICH WITH THE HELP OF THE BIDEN ADMINISTRATION, STATES LIKE CALIFORNIA AND NEW YORK EXPLOITED

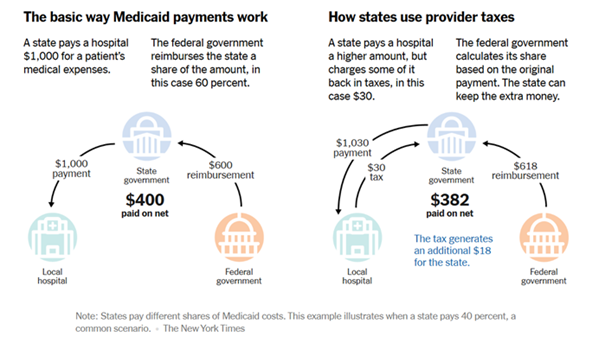

- “In its simplest form, the tax maneuver works like this: When a Medicaid patient goes to the hospital, the federal government and state usually share the costs. The ratio varies from one state to another… but the federal government often pays around 60 percent of the bill.”

- “States that use provider taxes to get more money usually start by paying the hospitals more. If the federal government is paying 60 percent and the state 40 percent, when a state bumps a payment to $1,030 from $1,000, the federal government chips in $618 instead of $600.”

- “With the tax, the state can actually earn itself money while also raising the hospital payment. Even if the state fully reimbursed the hospital for the amount of the tax, it would have some extra left over, because the new federal money more than covers the difference.” (The New York Times: G.O.P. Targets a Medicaid Loophole Used by 49 States to Grab Federal Money – 5/10/25)

- “In its final year, the last Administration approved four waivers that exploit this tax loophole, submitted by California, Michigan, Massachusetts, and New York. Together, these four states are responsible for more than 95% of projected federal taxpayer losses under the loophole.”

- “A CMS estimate shows that if just two more states adopt these schemes each year, excess federal costs could balloon more than $74 billion over 5 years.”

- “In California, Medicaid business in certain cases is taxed at $274 per member/per month, while non-Medicaid business is taxed at just $2 per member / per month. These arrangements allow states to benefit from a budget surplus to reinvest in unrelated programs—including the $8.5 billion program in California to cover more than 1.6 million illegal immigrants and other non-citizens.” (Center for Medicare and Medicaid Services: CMS Moves to Shut Down Medicaid Loophole—Protects Vulnerable Americans, Saves Billions – 5/12/25)

(The New York Times: G.O.P. Targets a Medicaid Loophole Used by 49 States to Grab Federal Money – 5/10/25)

Next Previous