Republicans’ Reconciliation Bill Strengthens Medicaid

By Instituting Commonsense Work Requirements, Removing Ineligible Enrollees, and Cracking Down on Blue States Abusing the Provider Tax and State-Directed Payments, Republicans’ Reconciliation Bill Ensures Medicaid Will Be There for Its Intended Recipients

MEDICAID WORK REQUIREMENTS WILL SAVE HUNDREDS OF BILLIONS OF DOLLARS AND HELP PRESERVE MEDICAID FOR MOTHERS, THE ELDERLY, PEOPLE WITH DISABILITIES, AND LOW-INCOME CHILDREN

- Republicans’ bill establishes work requirements for able-bodied adults who don’t have dependent children younger than 14 years of age or a disabled individual in their care. (U.S. Senate Committee on Finance: Crapo Highlights Tax Wins for Hardworking Americans and Main Street – 6/28/25)

- “Able-bodied adults without dependents can work, participate in a work training program, enroll in school or volunteer for 20 hours per week in order to receive taxpayer-subsidized Medicaid coverage.” (U.S. Senate Committee on Finance: Crapo Highlights Tax Wins for Hardworking Americans and Main Street – 6/28/25)

- The people states are required to cover under Medicaid will not lose coverage because they are not subject to the work requirements: “The work requirement doesn’t apply to anyone who is disabled, pregnant or caring for a child younger than age 14. Volunteering 20 hours a week or enrolled in school? You can get Medicaid.” (The Wall Street Journal: Editorial: No One is ‘Gutting’ the Safety Net – 7/4/25)

- These work requirements don’t go into effect until 2027. (Politico: Megabill may not be a silver bullet for Democrats in the midterms – 7/13/25)

- “The work requirements are projected to save about $325 billion over a decade.” (The Hill: Senate megabill marks biggest Medicaid cuts in history – 7/1/25)

- According to a March poll, 62% of Americans support Medicaid work requirements, including 82% of Republicans and 60% of independents. (Kaiser Family Foundation: KFF Health Tracking Poll February 2025: The Public’s Views on Potential Changes to Medicaid – 3/7/25)

REPUBLICANS’ BILL REMOVES INELIGIBLE ENROLLEES AND ENACTS ELIGIBILITY REQUIREMENTS TO ENSURE MEDICAID REMAINS AVAILABLE FOR ITS INTENDED RECIPIENTS

- “The Biden administration has enacted several major Medicaid rule changes with giant fiscal costs,” including a rule finalized in 2024 that keeps people on Medicaid “when they are no longer eligible,” while restricting the times “when states may verify changes in eligibility.” (Paragon Health Institute: Biden’s Medicaid Changes: High Costs, Misguided Policy – 11/6/24)

- “Per the Congressional Budget Office, federal outlays on [Medicaid] have been positively soaring, from $409 billion in 2019 to $615 billion in 2023, and projected to hit $655 billion in 2025. That’s a 50% jump from 2019 to 2023, and 60% to 2025.” (New York Post: Editorial: ‘Deadly’ GOP ‘cuts’ don’t even touch Medicaid’s 50% growth since 2019 – 6/3/25)

- “Over the last decade, Medicaid has outpaced the growth of the other two largest federal entitlement programs: Social Security and Medicare.” (Cato Institute: Medicaid Is Driving Deficits: Republicans Are Scarcely Tapping the Brakes – 5/13/25)

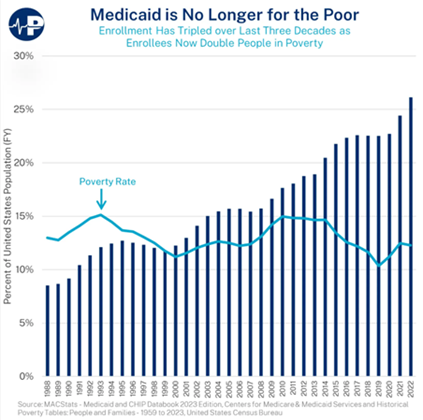

- Following Democrats’ expansion, Medicaid enrollment and costs have exploded:

(The New York Times: G.O.P. Targets a Medicaid Loophole Used by 49 States to Grab Federal Money – 5/10/25)

- Republicans are rooting out waste, fraud, and abuse from Medicaid:

- The bill removes ineligible enrollees, including those who are enrolled in multiple states. (U.S. Senate Committee on Finance: 2025 Tax Reform – accessed 7/15/25)

-

- “The GOP bill also includes sensible measures such as asking states to check their Medicaid expansion rolls every six months and more scrutiny on ObamaCare subsidies. That is necessary because the Biden Administration waved millions onto health entitlements. The Paragon Institute estimates that 6.4 million people are enrolled in fully subsidized ObamaCare plans but don’t meet the eligibility criteria. Apparently this is what Democrats support.” (U.S. Senate Committee on Finance: Crapo Highlights Tax Wins for Hardworking Americans and Main Street – 6/28/25; The Wall Street Journal: Editorial: No One is ‘Gutting’ the Safety Net – 7/4/25)

- Medicaid’s intended recipients will continue to receive Medicaid coverage: “Before passage of the Affordable Care Act, the Medicaid program focused on caring for seniors in need, pregnant mothers, children and Americans with disabilities. But in 2010, the ACA fundamentally changed Medicaid by shifting predominantly low-income adults — often without children, healthy and working-age — into a program that wasn’t designed for them.” (The Washington Post: op-ed: Making Medicaid a pathway out of poverty – 2/4/18)

THE BILL GRADUALLY LOWERS THE PROVIDER TAX OVER TIME, A PROVISION THAT BLUE STATES HAVE ABUSED AT THE EXPENSE OF AMERICAN TAXPAYERS

- The bill addresses the provider tax, which has ballooned the cost of Medicaid by allowing states to game the system and inflate costs. (U.S. Senate Committee on Finance: Crapo Highlights Tax Wins for Hardworking Americans and Main Street – 6/28/25)

- Beginning in 2028, the provider tax threshold will be lowered 0.5% per year from the current 6%, to 3.5% in 2032 and going forward. (U.S. Senate Committee on Finance: 2025 Tax Reform – accessed 7/15/25)

- President Obama’s FY2013 budget also proposed lowering the provider tax threshold to 3.5%: “The Administration proposes to limit these types of State financing practices that increase Federal Medicaid spending by phasing down the Medicaid provider tax threshold from the current law level of 6 percent in 2015, to 4.5 percent in 2015, 4 percent in 2016, and 3.5 percent in 2017 and beyond.” (Obama White House: The President's Budget for Fiscal Year 2013 – 2/13/12)

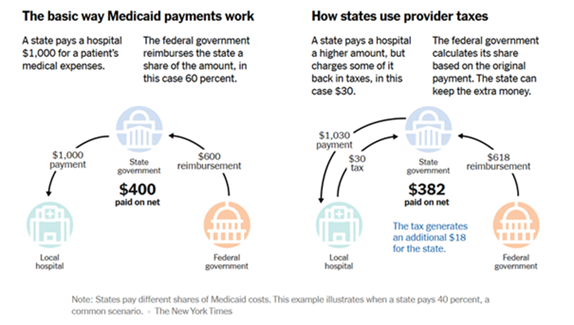

- “In its simplest form, the [provider tax] works like this: When a Medicaid patient goes to the hospital, the federal government and state usually share the costs. The ratio varies from one state to another… but the federal government often pays around 60 percent of the bill.”

- “States that use provider taxes to get more money usually start by paying the hospitals more. If the federal government is paying 60 percent and the state 40 percent, when a state bumps a payment to $1,030 from $1,000, the federal government chips in $618 instead of $600.”

- “With the tax, the state can actually earn itself money while also raising the hospital payment. Even if the state fully reimbursed the hospital for the amount of the tax, it would have some extra left over, because the new federal money more than covers the difference.” (The New York Times: G.O.P. Targets a Medicaid Loophole Used by 49 States to Grab Federal Money – 5/10/25)

-

- “In its final year, the last Administration approved four waivers that exploit this tax loophole, submitted by California, Michigan, Massachusetts, and New York. Together, these four states are responsible for more than 95% of projected federal taxpayer losses under the loophole.” (Center for Medicare and Medicaid Services: CMS Moves to Shut Down Medicaid Loophole—Protects Vulnerable Americans, Saves Billions – 5/12/25)

(The New York Times: G.O.P. Targets a Medicaid Loophole Used by 49 States to Grab Federal Money – 5/10/25)

THE BILL ALSO ADDRESSES STATE-DIRECTED PAYMENTS, WHICH HAVE BENEFITTED WELL-CONNECTED HOSPITALS OVER SMALL AND RURAL ONES

- The upper limit on state-directed payments to providers is reduced “from the average commercial rate to 100% of Medicare payment rates for expansion states and 110% for non-expansion states, with phase-in for certain approved grandfathered payments.” (Morgan Lewis: ‘One Big Beautiful Bill Act’: Key Final Medicaid Changes Explained – 7/9/25; U.S. Senate Committee on Finance: 2025 Tax Reform – accessed 7/15/25)

- A rule enacted by the Biden administration expanded “a Medicaid payment mechanism known as state-directed payments… which are a subset of Medicaid supplemental payments. In essence, these are lump sum payments to health care providers in addition to Medicaid payments for specific health care services that have been rendered.” (Paragon Health Institute: Biden’s Medicaid Changes: High Costs, Misguided Policy – 11/6/24)

-

- “State-Directed Payments (SDPs) are an extra payment, similar to a tip, on top of the base Medicaid payments that providers receive for providing a service to Medicaid enrollees… Spending on SDPs quadrupled under President Biden, increasing from $32 billion to $124 billion per year.” (White House: Memorandum to Senate Republicans – accessed 7/15/25)

-

- “By allowing states to direct higher payments to specific providers (mostly hospitals), this rule advantages politically-connected providers with increases in payments that will be mostly, if not entirely, covered by the federal government.” (Paragon Health Institute: Biden’s Medicaid Changes: High Costs, Misguided Policy – 11/6/24)

-

- “Another problem with this rule is that it incentivizes providers to increase their commercial rates.” (Paragon Health Institute: Biden’s Medicaid Changes: High Costs, Misguided Policy – 11/6/24)

-

- “Because of program integrity concerns, supplemental payments such as SDPs have historically been capped at Medicare rates.” (White House: Memorandum to Senate Republicans – accessed 7/15/25)

-

- “Medicaid SDPs, which primarily benefit hospitals, have surged both in their number and total spending, according to a recent staff report from the Medicaid and CHIP Payment and Access Commission (MACPAC). In 2024, the cumulative spending on federally approved SDPs was projected to reach $110 billion, up from a cumulative $69 billion by February 2023.” (HFMA: Medicaid directed payments draw scrutiny, potential changes – 12/6/24)

Next Previous